FINANCIAL ECONOMICS

FDI & Its Determinants in India

C S Shylajan, Assistant Professor in Economics, IBS Hyderabad 5/30/2011 12:36:56 AM

Foreign Direct Investment (FDI) is considered to be the lifeblood of economic development especially for the developing and underdeveloped countries. Multinational companies (MNCs) capitalise on foreign business opportunities by engaging in FDI, which is investment in real assets (such as land, buildings, or existing plants) in foreign countries. MNCs engage in joint ventures with foreign firms, acquire foreign firms, and form new foreign subsidiaries. It plays an important role in the long-term development of a country not only as a source of capital but also for enhancing competitiveness of the domestic economy through transfer of technology, strengthening infrastructure, raising productivity and generating new employment opportunities (Deutsche Bundesbank, 2003). MNCs are interested in boosting revenues through FDI by attracting new sources of demand, entering into profitable markets and exploiting monopolistic advantages. Currently these corporations are increasingly establishing overseas plants or acquiring existing overseas plants to learn the technology of foreign countries.

Foreign Direct Investment (FDI) is considered to be the lifeblood of economic development especially for the developing and underdeveloped countries. Multinational companies (MNCs) capitalise on foreign business opportunities by engaging in FDI, which is investment in real assets (such as land, buildings, or existing plants) in foreign countries. MNCs engage in joint ventures with foreign firms, acquire foreign firms, and form new foreign subsidiaries. It plays an important role in the long-term development of a country not only as a source of capital but also for enhancing competitiveness of the domestic economy through transfer of technology, strengthening infrastructure, raising productivity and generating new employment opportunities (Deutsche Bundesbank, 2003). MNCs are interested in boosting revenues through FDI by attracting new sources of demand, entering into profitable markets and exploiting monopolistic advantages. Currently these corporations are increasingly establishing overseas plants or acquiring existing overseas plants to learn the technology of foreign countries.

In India, FDI is considered as a developmental tool, which can help in achieving self-reliance in various sectors of the economy. With the announcement of Industrial Policy in 1991, huge incentives and concessions were granted for the flow of foreign capital to India. India is a growing country which has large space for consumer as well as capital goods. India’s abundant and diversified natural resources, its sound economic policy, good market conditions and highly skilled human resources, make it a proper destination for foreign direct investments.

In India, FDI is considered as a developmental tool, which can help in achieving self-reliance in various sectors of the economy. With the announcement of Industrial Policy in 1991, huge incentives and concessions were granted for the flow of foreign capital to India. India is a growing country which has large space for consumer as well as capital goods. India’s abundant and diversified natural resources, its sound economic policy, good market conditions and highly skilled human resources, make it a proper destination for foreign direct investments.

As per the recent survey done by the United National Conference on Trade and Development (UNCTAD), India will emerge as the third largest recipient of foreign direct investment (FDI) for the three-year period ending 2012 (World Investment Report 2010). As per the study, the sectors which attracted highest FDI were services, telecommunications, construction activities, and computer software and hardware. In 1991, India liberalised its highly regulated FDI regime. Along with the virtual abolition of the industrial licensing system, controls over foreign trade and FDI were considerably relaxed. The reforms did result in increased inflows of FDI during the post reform period. The volume of FDI in India is relatively low compared with that in most other developing countries.

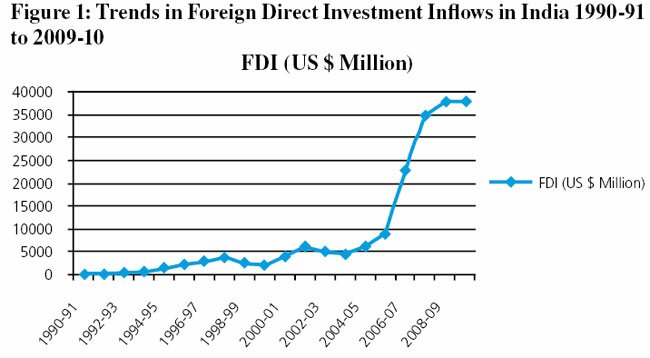

FDI Inflows in India

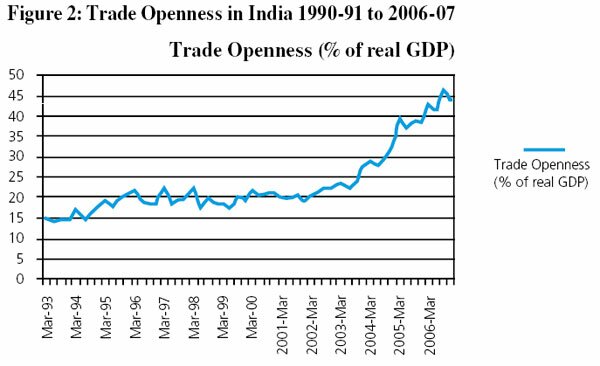

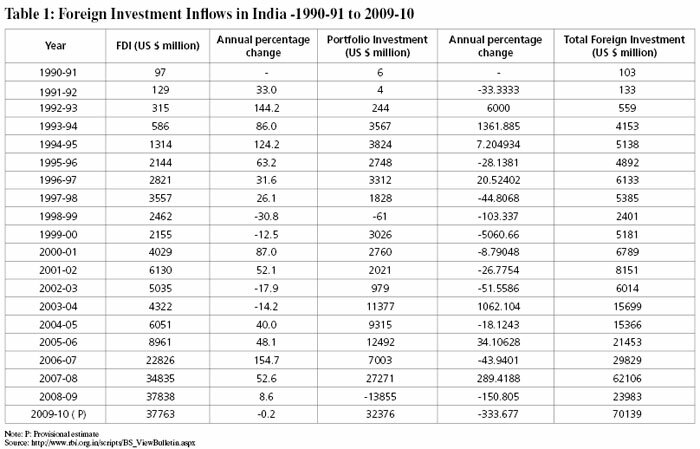

Recognising the importance of FDI in the accelerated economic growth of the country, Government of India initiated a number of economic reforms in 1991. As a result of the various policy initiatives taken, India has been rapidly changing from a restrictive regime to a liberal one, and FDI is encouraged in almost all the economic activities under the Automatic Route. FDI is freely allowed in all sectors including the services sector, except a few sectors where the existing and notified sectoral policy does not permit FDI beyond a ceiling. To make the investment in India attractive, investment and return on them are freely repatriable, except where the approval is specific to specific conditions such as lock-in period on original investment, dividend cap, foreign exchange neutrality etc as per the notified sectoral policy (Govt. of India, 2003). After the economic reforms are implemented in the post 1990s, the inflows of FDI to India have increased tremendously since 2000 (Fig-1 and Table-1). The opening up of the Indian economy in the international trade front and more liberal FDI policies has been one of the factors which led to huge FDI inflows in India (Fig-2). However, India's FDI inflows have fallen sharply this financial year as a stumbling global recovery from global crisis hit investor appetite. Again, the macroeconomic instability in terms of fiscal deficit, current account deficit and high inflation rate also contribute to fall in FDI inflows. As Economic Survey 2010-11 has reported, inflation is a dominant concern and India needs policies to help reverse a fall in FDI inflows.

In India, Reserve Bank of India (RBI) publishes foreign investment data on a monthly basis in the RBI Bulletin, which provides component-wise details of direct investment and portfolio investment. Direct investment comprises of inflows through (i) Government (SIA/FIPB) route, (ii) RBI automatic route, (iii) NRI and (iv) Acquisition of shares. Portfolio investment covers: (i) GDRs/ADRs (ii) FIIs and (iii) offshore funds and others.

Objectives of the Study

The present study tries to empirically examine the major factors which have determined the inflow of FDI in India in the post reform period.

Determinants of FDI:

Literature Review of Theory and Empirical Evidence

A country which has a stable macroeconomic condition with high and sustained growth rates will receive more FDI inflows than a more volatile economy. The variables that measure the economic stability and growth are GDP growth rate, interest rates, inflation rates etc. Investors prefer to invest in more stable economies that reflect a lesser degree of uncertainty and risk. Therefore, it is expected that GDP growth rate, industrial production, and interest rates would influence FDI flows positively and the inflation rate would influence positively or negatively. Market size plays an important role in attracting foreign direct investment from abroad. Market size is measured by GDP. Market size tend to influence the inflows, as an increased customer base signifies more opportunities of being successful and also the fact that with the rampant development the purchasing power of the people has also been greatly influenced moving to many levels higher in comparison to what it was before the economic growth.

Trade openness is also considered to be one of the key determinants of FDI as represented in the past literature; much of FDI is export oriented and may also require the import of complementary, intermediate and capital goods. Thus trade openness is generally expected to be a positive and significant determinant of FDI. Trade openness is the sum of exports and imports of goods and services measured as a share of gross domestic product. The amount of domestic investments also influences the levels of FDI inflows into various sectors. Real interest rate and inflation affects the inflow of foreign investments especially direct investment. Real interest rate and inflation mainly measure the economic stability of an economy.

There are many past studies which have emphasized the role of GDP growth, wage rate, trade rate, real interest rates, inflation, and stock of FDI, domestic investment in attracting FDI into a country. Burak Camurdan and Ismail Cevis (2009) develop an empirical framework to estimate the economic determinants of FDI inflows by employing a panel data set of 17 developing countries and transition economies for the period of 1989-2006. Seven independent variables are taken for this research namely, the previous period FDI, GDP growth, wage, trade rate, the real interest rates, inflation rate, and domestic investment. The results conclude that the previous period FDI is important as an economic determinant. Besides, it is also understood that the main determinants of FDI inflows are the inflation rate, the interest rate, the growth rate and the trade (openness) rate.

Hosein Elboiashi et al (2009) investigate the causal relationships between foreign direct investment (FDI), domestic investment (DI) and economic growth (GDP) in Egyptian, Moroccan and Tunisian economies. This paper applies a cointegration time series techniques; vector error correction (VEC) model over the sample period for the period from1970 to 2006. They find a unidirectional causality between FDI and GDP in Egypt and Morocco, and bi-directional causality between FDI and GDP in Tunisia. Domestic investment has played a great role for driving FDI into these countries more than GDP. The study also shows that FDI is more effective than DI for promoting growth.

A study by Ana Marr (1997), reviews the recent evidence on the scale of FDI to low-income countries over the period 1970- 96 and major factors determining foreign companies’ decisions to invest in a particular country. The paper concludes that large market size, low labor costs and high returns in natural resources are amongst the major determinants in the decision to invest in these countries. China, as a major emerging market, has attracted significant flows of FDI, to become the second largest receipt. Shaukat Ali and Wei Guo (2005) briefly examine the literature on FDI and focuses on likely determinants of FDI in China. They analyze responses from 22 firms operating in China on what they see as the important motivations for them to undertake FDI. Results show that market size (in terms of GDP) is a major factor for FDI especially for the United States firms. For local, export-orientated, Asian firms, low labor costs are the main factor.

Methodology and Data

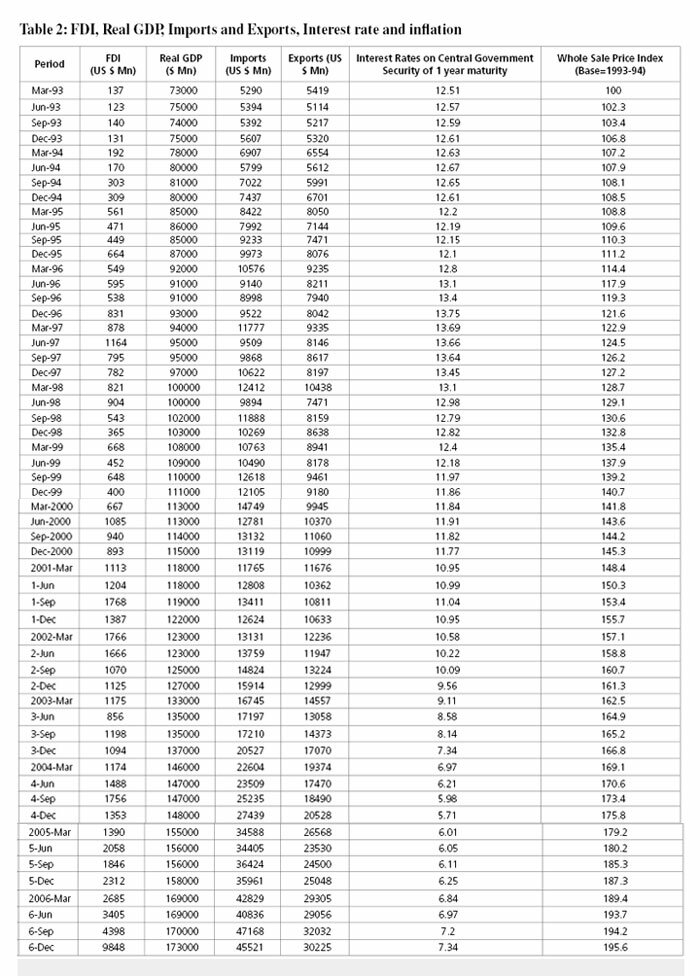

The period taken for the present study is the post liberalisation period from 1993 to 2006. India adopted many economic reforms in 1991 to open up the economy. The FDI started flowing into the country with the significant proportions. The reason for taking period only up to 2006 is that the period from 2007 to 2010 was characterised by global financial crisis which may have an impact on FDI. So, including the period from 2007 to 2010 may give us spurious empirical results and may act as an outlier for the whole data set. Multiple regression analysis has been used to find the determinants of FDI in India. In the regression, dependent variable is taken as the quarterly data on FDI in India from the period of 1993 to 2006. The independent variables considered in the model are quarterly data on inflation, interest rate (Interest Rates on Central Government Security of one year maturity), real GDP, previous period FDI, previous period GDP and trade openness. Table 2 reports the data on FDI, export, import, real GDP, interest rate and inflation. We have used quarterly data of Wholesale Price Index (WPI) for measuring inflation.

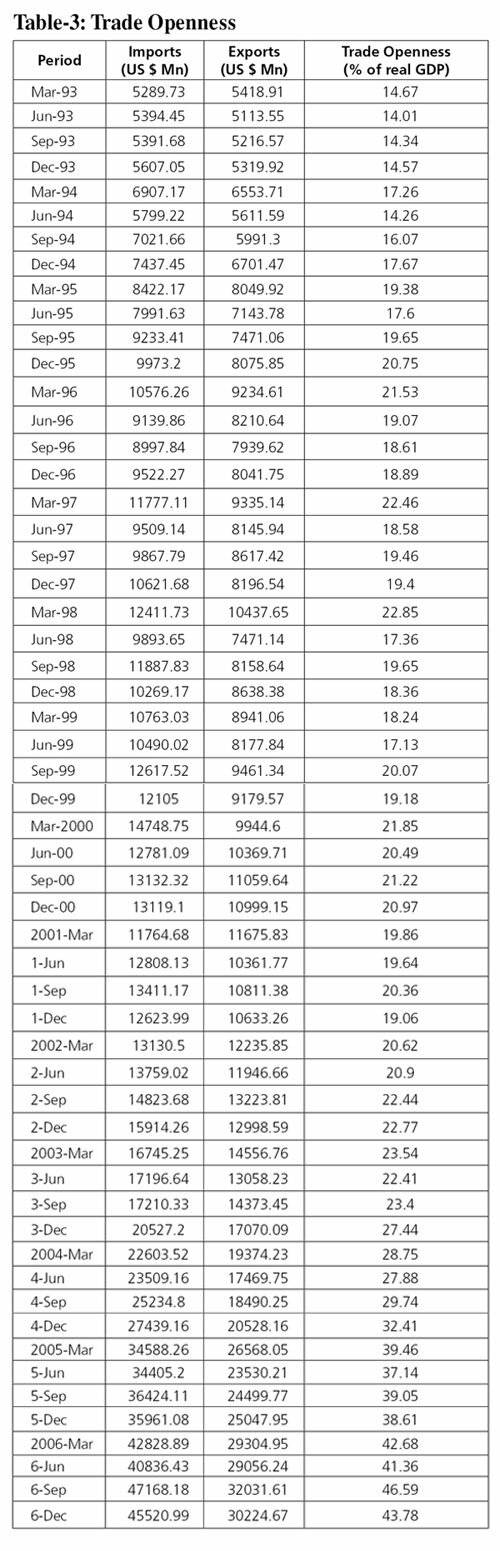

Trade Openness refers to the degrees to which countries or economies permit or have trade with other countries or economies. It is calculated as export plus import as percentage of GDP. This data has been reported in Table 3.

Results and Discussion

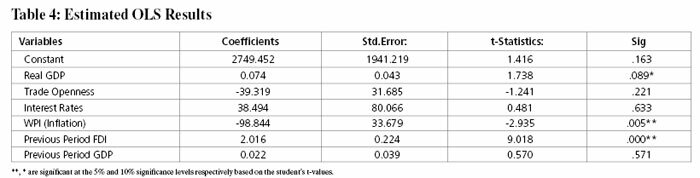

As explained in the table output, the dependent variable in the regression is FDI and the independent variables are real GDP, previous period FDI, previous period GDP, Trade Openness, Interest Rates, and WPI. The results show that FDI is explained close to 86% by the independent variables included in this study. The Durbin Watson value is close to 2 which imply that there exist no autocorrelation into the data.

The results given in the table 4 shows that inflation, real GDP and previous period FDI are important factors in attracting the FDI inflows in India during the post reform period. Previous period FDI and level of inflation in the economy or price stability have significantly contributed in explaining the inflow of FDI. While previous period FDI is positively influences the FDI, inflation in the economy negatively affects the FDI inflows. However, real GDP has positive influence on FDI and is statistically significant at 10 percent significance level. However, trade openness, interest rates and economic growth in the previous period are not important factors in explaining FDI inflows in India.

Conclusion

FDI plays an important role in economic growth of an economy. Literature on factors determining FDI inflows into an economy shows that many factors influences inflows such as market size, inflation, trade openness, interest rate, wage rate, business environment, etc. The present study examined the factors determining FDI inflows in India during post reform period. The results of our analysis show that FDI is related positively with real GDP and previous period FDI inflow but inversely related with inflation. It showed that the macroeconomic instability in terms of inflation has been an important factor which influenced the inflow of FDI in India in the post reform period.

References and Additional Thinking

- Ana Marr (1997), ‘Foreign Direct Investment Flows to Low-Income Countries: A Review of the Evidence’, Overseas Development Institute, pp.1-11.

- Burak Camurdan, Ismail Cevis, (2009), ‘The Economical Determinants Of Foreign Direct Investment (FDI) In Developing Countries And Transition Economies’, e-Journal of New World Sciences Academy, Volume: 4, Number: 3, Article Number: 3C0015

- Deutsche Bundesbank (2003) ‘The Role of FDI in emerging market economies compared to other forms of financing: Past developments and implications for financial stability’

- http://www.bis.org/publ/cgfs22buba1.pdf

- Government of India (2003) Manual on FDI in India: Policy and Procedures, Secretariate for Industrial Promotion, Department of Industrial Policy and Promotion, Ministry of Commerce and Industry.

- Hosein Elboiashi, Farhad Noorbakhsh, Alberto Paloni and Celine Azemar, (2009), ‘The causal relationships between Foreign Direct Investment (FDI), Domestic Investment (DI) and Economic Growth (GDP) in North African non-oil producing Countries:Empirical Evidence from Cointegration Analysis’, Advances In Management Vol. 2 (11)

- Jung Wan Lee, (2009), ‘The Effects of Foreign Direct Investment on Economic Growth of A Developing Country: From Kazakhstan’, Proceedings of the Academy for Economics and Economic Education, Volume 12, Number 2

- Kishor Sharma (2000), ‘Export Growth in India: Has FDI Played A Role?’, Economic Growth Center, Yale University, Center Discussion Paper No. 816, pp.5-22.

- Shaukat Ali and Wei Guo, (2005) ‘Determinants of FDI in China, Journal of Global Business and Technology, Volume 1, Number 2, pp.1-13.

- UNCTAD, The World Investment Report 2010: Investing in a Low-carbon Economy (WIR10)

(Dr. C S Shylajan is presently working as Professor in Economics at IBS, Hyderabad. He teaches Macro Economics & Business Environment, Managerial Economics, and International Finance & Trade for MBA students. He received PhD in Economics from Madras School of Economics and Post Doctoral from IIM Calcutta. He was also a Visiting Scholar at ICTP, Italy. He has published research articles in refereed national and international journals and made presentations in the conferences in Italy, Indonesia etc. His area of research interest is Environment and Resource Economics. He has authored a book titled ‘Economic Instruments for Managing Solid Waste in India’. He is Associate Editor of International Journal of Ecology and Development and the Consulting Editor of IUP Journal of Public Finance.

The views expressed in the write-up are personal and do not re?ect the official policy or position of the organization.)

<

|

| |

|

| |

|

|

*

|

| Name: |

* |

| Place: |

* |

| Email: |

* *

|

| Display Email: |

|

| |

|

| Enter Image Text: |

|

| |

|