FINANCIAL ECONOMICS

India Inflation Explained

Madhusudan Raj, Alumnus, Ludwig von Mises Institute, Auburn Alabama, U.S.A. 30/05/2011 12:50:08 AM

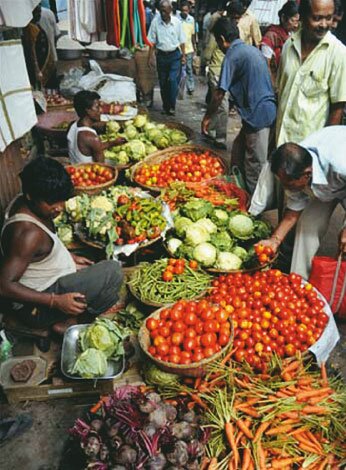

In this crisis ridden world, economies around the world are experiencing high bouts of inflation1 and India is no exception to that. Indian economy is facing the effects of severe inflation in the form of rising food and energy prices. Indian government is either clueless about the cause of this inflation or is pretending to be clueless to fox the people from seeing the true cause of this rise in prices. Moreover, it is trying to divert everyone's attention from the true cause of inflation by creating scapegoats like consumers (high demand), hoarders, speculators, food drought etc. This is an age old trick which all governments use to fool its populace when it embarks on the inflationary path in full speed.

In this crisis ridden world, economies around the world are experiencing high bouts of inflation1 and India is no exception to that. Indian economy is facing the effects of severe inflation in the form of rising food and energy prices. Indian government is either clueless about the cause of this inflation or is pretending to be clueless to fox the people from seeing the true cause of this rise in prices. Moreover, it is trying to divert everyone's attention from the true cause of inflation by creating scapegoats like consumers (high demand), hoarders, speculators, food drought etc. This is an age old trick which all governments use to fool its populace when it embarks on the inflationary path in full speed.

In this short paper I will expose the lies of Indian government and will explain the true cause of inflation.

Why inflation?

Henry Hazlitt — the great Austrian economist of the 20th century — in his one page missive explained the phenomenon of inflation in the following words:

Inflation is an increase in the quantity of money and credit. Its chief consequence is soaring prices. Therefore inflation — if we misuse the term to mean the rising prices themselves — is caused solely by printing more money. For this the government’s monetary policies are entirely responsible. (Hazlitt, 2004).

Inflation is an increase in the quantity of money and credit. Its chief consequence is soaring prices. Therefore inflation — if we misuse the term to mean the rising prices themselves — is caused solely by printing more money. For this the government’s monetary policies are entirely responsible. (Hazlitt, 2004).

As Hazlitt put it very trenchantly, inflation is increase in the supply of money and credit due to government's money printing process through its central bank (RBI in case of India). Its primary effect is rise in prices across the economy, although initially in an uneven manner, and then generalized once full inflationary effect sets in2. The reason there is double digit inflation in India (and around the world) is this same government money printing process worldwide through its central banks, especially printing by US federal reserve i.e., the so-called 'quantitative easing'3 program (QE1, QE2 and soon to be announced QE3, QE4 and so on).

Since the beginning of recent financial crisis in 2008, Indian government through RBI is printing and injecting gargantuan amount of money in the economy. Here are the evidences:

1. Stimulus package 1: Newspaper, The Hindu (A. Dasgupta, 2008) reported that, unveiling the much-awaited stimulus package to shore up various sectors of the economy from the global downturn, the government on Sunday effected an across-the-board four percent cut in Cenvat to bring down the prices of cars, cement, textiles and other products, and earmarked an additional Rs. 20,000 crore for infrastructure, industry and export sectors for the current fiscal.

2. Stimulus Package 2: Indiaserver.com (Indiaserver.com, 2009) reported that, in less than a month since the UPA government announced a Rs 32,000 crore booster dose for the slowing economy, it came out with a more comprehensive and detailed stimulus package valued at over Rs. 20,000 crore. Montek Singh Ahluwalia, Deputy Chairman, Planning Commission announced the “Round II Package”, the last of this fiscal, focusing on stressed sectors like non-banking finance companies, real estate, infrastructure and small and medium businesses.

3. Stimulus Package 3: Finance buzz (Narayanan, 2009) reported that, India on Tuesday provided two percent cut in excise duty and service tax to give boost to the country’s economy….these duty reductions are likely to cost the treasury nearly Rs. 30,000 crore. This is above the four percent cut in CENVAT announced in December 2008, which has now been extended to beyond March 31.

4. The mega money printing process which started in 2008 still continues. For example, in October 2010 RBI bought back up to Rs. 12,000 crore of government securities as part of the government’s cash management operations (Roy, 2010). Just after couple of months, again in December 2010, RBI purchased government securities worth Rs. 12,000 crore (Prasad, 2010). Under this same mechanism RBI purchased total Rs. 48,000 crore worth of government security in various rounds of Open Market Operations (Sampat, 2011).

5. Since November 2010 Indian banks are borrowing on an average one trillion rupees daily from RBI!!! (D'silva, 2010).

6. Indian government is pumping crores of rupees for bailing out bankrupt inefficient public sector units e.g., recent Air India bailout of Rs. 12 billion rupees (Reuters, 2010).

Not only this, USA is also exporting inflation around the globe through its QE programs. How? Let us see.

The US dollar is an international reserve currency. That means citizens of every country need it for trade transactions with citizens of other country4. Thus the demand for dollar is universal due to its international reserve currency status.

After the financial crash of 2007, US economy is in recession. To take the economy out of recession US central bank Federal Reserve and the Federal government is following Monetarists and Keynesian policies. In nutshell these policies are nothing but printing massive amount of money and thus increasing the money supply5. These people (falsely) believe that spending huge amount of paper currency will spur the aggregate demand and that will lift the economy out of recession. Following this reasoning US Fed is conducting its QE programs, and Potomac is accumulating massive amount of debt.6

This deliberate policy of debasing the dollar is resulting into two things:

1. Commodity (crude oil, food items like wheat, rice etc., base metals like copper, aluminum etc.) prices are rising because they are traded in dollar in international market7. These are all important items in India's import bill Because of these costly imports Indian domestic prices are going higher e.g., petrol/gas prices.

2. International Investors are pouring the newly created supply of dollars into emerging market economies to protect their returns which is losing value because of weak dollar and ultra low interest rates in the developed world markets. This hot money8 is pouring in the Indian capital markets (BSE, NSE etc.) lifting the rupee-dollar exchange rate resulting into rupee appreciation against the dollar. Strong rupee is creating troubles for the exporters. They are finding it difficult to sell their now dearer products in the international market. Because of this, they are lobbying the government for protection. Today's mercantilist governments (falsely) believe that export is good for the economy and import is bad so they always try to boost their export sectors by artificially keeping their currency cheap in the international market (beggar thy neighbor policy). To stop rupee from appreciating, RBI is intervening into Forex market to buy dollars to make rupee cheap again9. For that they are printing more rupees. This increases the supply of rupee, which is inflation.

2. International Investors are pouring the newly created supply of dollars into emerging market economies to protect their returns which is losing value because of weak dollar and ultra low interest rates in the developed world markets. This hot money8 is pouring in the Indian capital markets (BSE, NSE etc.) lifting the rupee-dollar exchange rate resulting into rupee appreciation against the dollar. Strong rupee is creating troubles for the exporters. They are finding it difficult to sell their now dearer products in the international market. Because of this, they are lobbying the government for protection. Today's mercantilist governments (falsely) believe that export is good for the economy and import is bad so they always try to boost their export sectors by artificially keeping their currency cheap in the international market (beggar thy neighbor policy). To stop rupee from appreciating, RBI is intervening into Forex market to buy dollars to make rupee cheap again9. For that they are printing more rupees. This increases the supply of rupee, which is inflation.

Once inflation is created by the Indian government, RBI, and USA, its evil effects slowly spreads into economy in the form of higher prices. As the printed rupee gets into people's hand (in form of wages, loans etc.) they go and spend that money in the market for consumption raising demand for goods and services compared to its available supply at that given point of time, which bids the prices of those goods and services higher.

Supply shock in the form of political maneuverings by the politicians and a huge resource misallocation by the government central planning (taxes, subsidies, import/export ban etc.) exacerbates this situation. On one side rupee is losing its purchasing power because of Indian government's money printing programs and on other side already scarce supply becomes even scarcer due to various supply shocks. This results into astronomically higher prices of various products.

Conclusion

Inflation in India and all around the world is a result of government & central bank's crazy Keynesian Monetarists policies of printing money to get economies out of recession. They don't understand that, by printing money they are only going to create more havoc in people's life by creating inflation or possible hyperinflation. Printing money is not wealth creation. It actually destroys wealth. It results in capital consumption which reduces the possibilities of higher economic growth in future. People need to understand that consumption never drives any economy. Economies grow because of savings, capital accumulation and production. Without production, consumption is impossible.

But, following their inherent inflationary nature, governments around the world are planning to blow another big economic bubble in the form of printing of 100 trillion dollar worth of fiat currency as a measure of global quantitative easing! This plan was discussed in recently concluded Davos World Economic Forum10. Recently published papers of International Monetary Fund (IMF, 2010, 2011) lay out the blue print of future monetary system of one world paper currency named after Keynesian dream, Bancor. This plan, if successful, will plunge the world into a systematic worldwide inflation and ensuing global super depression.

End-notes

1 To see an interactive graphic chart of ongoing inflationary situation around the globe please visit the following website — http://graphicsweb.wsj.com/documents/INFLATION1101/INFLATION1101.html#view=ecSizeDESC

2 This phenomenon is called the ‘Cantillon effect’ after Richard Cantillon. To know more about Cantillon please refer to, http://en.wikipedia.org/wiki/Richard_Cantillon#cite_note-66 (accessed on, 3/10/2011 8:26:13 AM).

3 To read more about this program please see, http://en.wikipedia.org/wiki/Quantitative_easing

4 Although now many countries have started to dump the dollar because of its falling purchasing power as a reserve currency e.g., recently China and Russia decided to carry out their mutual trade in their respective currencies (Li, 2010). And now India and China has also decided to dump the dollar (S. Dasgupta, 2011).

5 See the money supply data here,

http://mises.org/content/nofed/chart.aspx?series=TMS

6 Check out the live data of US government debt here — http://www.usdebtclock.org/

7 For evidence see, (Bureau, 2011a, 2011b; Finance, 2011).

8 Hot money is a term that is most commonly used in financial markets to refer to the flow of funds (or capital) from one country to another in order to earn a short-term profit on interest rate differences and/or anticipated exchange rate shifts. These speculative capital flows are called "hot money" because they can move very quickly in and out of markets, potentially leading to market instability (Wikipedia, 2011).

9 For evidence see, (RBI, 2011; Reuters, 2010b).

10 You can read this news here,

http://www.telegraph.co.uk/finance/financetopics/davos/8267768/World-needs-100-trillion-more-credit-says-World-Economic-Forum.html (accessed on, 3/10/2011 9:23:27 AM).

References and Additional Thinking

• Bureau, Commodity Research. (2011a). BLS Spot Index Cash (CRB) Chart. from Commodity Research Bureau — A Bar Chart Company:

• Bureau, Commodity Research. (2011b). CRB CCI Index Cash (ICEFI) Chart. from Commodity Research Bureau — A Bar Chart Company:

• D'silva, Neha. (2010). Monetary conditions too tight for RBI rate hike. Reuters India. Retrieved from http://in.reuters.com/article/2010/12/15/idINIndia-53579920101215

• Dasgupta, Ashok. (2008). Government unveils stimulus package The Hindu. Retrieved from

• Dasgupta, Saibal. (2011). Bank of India becomes first to offer trade settlement in yuan. The Times of India. Retrieved from

• Finance, Yahoo. (2011). Rogers International Commodity (^RCT). from Yahoo Finance:

• Hazlitt, Henry. (2004). Inflation in One Page. The Freeman, November.

• IMF. (2010). Reserve Accumulation and International Monetary Stability. Retrieved from http://www.imf.org/external/np/pp/eng/2010/041310.pdf.

• IMF. (2011). Enhancing International Monetary Stability — A Role for the SDR? Retrieved from http://www.imf.org/external/np/pp/eng/2011/010711.pdf.

• Indiaserver.com. (2009). Government, RBI Deliver Second Stimulus Package. Indiaserver.com. Retrieved from http://www.india-server.com/news/government-rbi-deliver-second-stimulus-5467.html

• Li, Hao. (2010). China-Russia currency agreement further threatens U.S. dollar. International Business Times.

Retrieved from http://www.ibtimes.com/articles/85424/20101124/china-russia-drop-dollar.htm

• Narayanan, K.S. (2009). 3rd Stimulus: 2 pc cuts in excise duty & service tax. Finance buzz. Retrieved from

• Prasad, Ajit. (2010). RBI Announces OMO Purchase of Government Securities for Rs. 12,000 crore on December 15, 2010. Retrieved from .

• RBI. (2011). Sale / Purchase of US Dollar by Reserve Bank of India. Retrieved March 11, 2011, from Reserve Bank of India:

• Reuters. (2010a). Cabinet OKs 12-bln-rupee infusion into Air India. Reuters India. Retrieved from http://in.reuters.com/article/2010/12/30/idINIndia-53853220101230

• Reuters. (2010b). Rupee hits 25-month peak; RBI buys dollars. DNA: Daily News and Analysis. Retrieved from

http://www.dnaindia.com/money/report_rupee-hits-25-month-peak-rbi-buys-dollars_1452580

• Roy, Anup. (2010). RBI to buy bonds to infuse liquidity in cash-starved system. Livemint.com. Retrieved from

• Sampat, Malvika. (2011). RBI to buy securities worth Rs .12,000 crore from the government. Invest in India. Retrieved from http://investmoneyinindia.com/2626/rbi-to-buy-securities-worth-rs-12000-crore-from-the-government

• Wikipedia. (2011). Hot Money. Retrieved 11th March, 2011, from http://en.wikipedia.org/wiki/Hot_money

(Madhusudan Raj teaches Austrian Economics at the department of Economics and the department of Human Resource Development, Veer Narmad South Gujarat University, Surat, India. He is an alumnus of the Mises University, Ludwig von Mises Institute, Auburn, Alabama, U.S.A., and holds a bachelor's, master's, M.Phil., and Ph.D. degree in Economics from the South Gujarat University.

The views expressed in the article are personal and do not reflect the official policy or position of the organisation.)

<

|

| |

|

| |

|

|

*

|

| Name: |

* |

| Place: |

* |

| Email: |

* *

|

| Display Email: |

|

| |

|

| Enter Image Text: |

|

| |

|