UNLEASHING URBANIZATION

Building Modern 'Urban' India

Rok Spruk, Economics Research Fellow European Enterprise Institute, Brussels 1/1/2011 12:13:02 AM

The challenges of urban development are indeed one of the most perennial questions in the context of economic development. After two decades of high economic growth, the state of urban development in emerging markets can be understood both as a challenge in improving the standard of living and as an opportunity to review some of the issues posed by the population growth. In recent years, the growth of megacities has received considerable attention, especially from the perspective of cost-benefit analysis. The unparalleled increase in the emergence of megacities has raised numerous questions regarding the evaluation of megacities. Are megacities sustainable in poor countries considering the improvement of living facilities, access to clean water, the quality of transportation infrastructure? Can the allocation of scarce resources in the course of urban development be solved by planning solutions? How to explain the evolution of slums? These questions lie at the heart of emerging countries since the improvement of urban living conditions affects not only the standard of living but also the quality of infrastructure. The latter is, aside from institutional quality, deemed essential for higher standard of living and higher long-run economic growth. The aim of this article is to discuss some of the most challenging puzzles of urban development faced by India.

The challenges of urban development are indeed one of the most perennial questions in the context of economic development. After two decades of high economic growth, the state of urban development in emerging markets can be understood both as a challenge in improving the standard of living and as an opportunity to review some of the issues posed by the population growth. In recent years, the growth of megacities has received considerable attention, especially from the perspective of cost-benefit analysis. The unparalleled increase in the emergence of megacities has raised numerous questions regarding the evaluation of megacities. Are megacities sustainable in poor countries considering the improvement of living facilities, access to clean water, the quality of transportation infrastructure? Can the allocation of scarce resources in the course of urban development be solved by planning solutions? How to explain the evolution of slums? These questions lie at the heart of emerging countries since the improvement of urban living conditions affects not only the standard of living but also the quality of infrastructure. The latter is, aside from institutional quality, deemed essential for higher standard of living and higher long-run economic growth. The aim of this article is to discuss some of the most challenging puzzles of urban development faced by India.

Using the Market for Urban Development

Public policies in emerging countries devoted a considerable amount of attention to the growth and evolution of urban areas in the Western world as a role model in boosting urban development in emerging regions. Public policies in less developed countries have often adopted a principle of copying urban solutions from the West into particular areas such as town planning and slum reduction. A brief look upon the historical emergence of some of the world’s biggest cities such as New York, London and Amsterdam and the comparison of the urban development philosophy in poorer regions of the World reveal a striking difference in understanding urban development. To understand the brisk growth of New York City, which emerged from New Amsterdam in 1674 after Westminster Treaty between the United Kingdom and Holland, it is impossible to ponder the efficiency of urban development without the institutional setback. Land division in early New Amsterdam was subject to a rigorous protection of property rights, safeguarding trade and investment. The colonial origins of the tradition of strong property rights continued well into the 18th and 19th century, having firmly established the rule of law as the cornerstone of the city growth. From the second half of the 20th century, third-world nations fell under considerable influence of government management of urban development. Contrary to market-based solutions, government interference with urban management in the last century unfolded a bold conviction that urban development can be solved by tentatively planned solutions and urban intervention. Without any hesitation, the quality of living in urban areas in least developed and developing countries still suffers heavily from the legacy of authoritarian regimes which, in spite of relentless attempts to fulfill utopian promises to eradicate poverty and improve the quality of urban facilities, proved that government failure of state-wide urban planning was immense. The emergence of slum population in less developed countries reflects an inherent government failure to enforce low-cost institutions based on the rule of law and private property rights protection. It is impossible to envision urban development without a clear framework of the rules of the game.

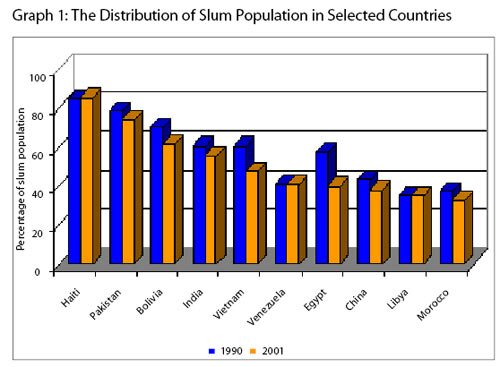

Graph 1 depicts the percentage of slum population in 1990 and 2001 in 10 countries. In India, the percentage of slum population decreased by 5.3 percentage points between 1990 and 2001.

The evolution of slum communities culminated the absence of clearly defined property rights and contract enforcement which consequently resulted in poor water and sanitation facilities. The absence of the constitutional protection of private property rights quickly resulted in subsequent land expropriation. The outcome originates in the belief that the purpose of private property is, inherently, to pursue social goals. Once the belief is encroached in the political philosophy, the economic consequences are detrimental. Given the extent of uncertainty, the individuals’ choice of living in slums is derived from a realm of economic and institutional rigidities. In fact, the combination of inherent perception of autarkic informal institutions and the political power of elites jointly resulted in poor incentives to boost urban development, given the prevalence of slum population in urban settlements and high rates of crime and shadow economy. Hernando de Soto, the Peruvian economist, famously captured the essence of property rights while describing the absence of law and property rights in Indonesia:

“I was in Indonesia to launch the translation of my previous book into Bahasa Indonesian, and they took that opportunity to invite me to talk about how they could find who owns what among 90 percent of Indonesians who live in the extralegal sector. Fearing that I would lose my audience if I went into drawn-out technical explanation on how to structure a bridge between the extralegal and legal sector, I came up with another way - an Indonesian way - to answer their question. During my book tour, I had taken a few days off to visit Bali, one of the most beautiful places on Earth. As I strolled through rice fields, I had no idea where the property boundaries were. But the dogs knew. Every time I crossed from one farm to another, a different dog barked. Those Indonesian dogs may have been ignorant of formal law, but they were positive about which assets their masters controlled. I told the ministers that Indonesian dogs had the basic information they needed to set up a formal property system. By travelling their city streets and countryside and listening to barking dogs, they could gradually work upward, through the vine of extralegal representations dispersed throughout their country, until they made contact with the ruling social contract. ‘Ah,’ responded one of the ministers, ‘Jukum Adat [the people’s law]!”1

From the economic perspective, market failure in urban development arises from asymmetric information, adverse selection and network externalities. The adverse effects of slum population typically result in poor education outcomes, high crime rates that eventually lead to the vicious circle of poverty and underdevelopment. It is inevitably important for public policymakers to recognize the causes of the widespread growth of slum population rather than direct solutions applied by the government interference. It is impossible to improve urban living conditions without a careful consideration of what actually spurred a contagious spread of the growth of slum communities which nonetheless result in subversive consequences for the quality of urban development and standard of living. The institutional preconditions for urban development require a bold and definitive adoption of property rights protection. The absence of risk of property expropriation, enhanced by the well-functioning judicial system is a necessary precondition for an organic and spontaneous urban development. Once the adoption of the formative mechanism of a guaranteed protection of property rights and contract enforcement is established for rich and poor, the quality of urban infrastructure would probably undergo a dramatic improvement if the access to non-exclusionary public goods is provided.

Population Growth and Agglomeration Density

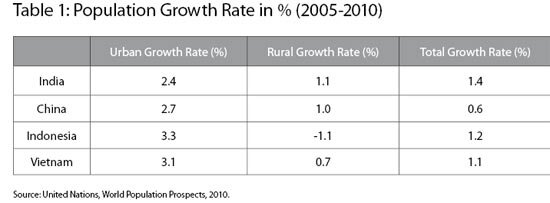

In its broadest sense, urban development is a complex set of measures at the intersection of economic, political, demographic and institutional features. In recent years, the literature on urban development has emphasized the impact of population growth on urban development. High population growth driven by high fertility rate and low old-age dependency ratio could undermine the growth of megacities if the institutional weakness in safeguarding private property rights and the rule of law prevail. Table 1 depicts population growth rates for selected emerging countries. In the last five years, total population growth rate in India stabilized at 1.4 percent. However, the growth rate of urban population exceeded the growth rate of rural population by twice. U.S Census Bureau estimated that the expected population growth rate in India in 2025 is one percent.2 The economic benefits of high population growth stem from network externalities in the marginal cost of public goods provision since the greater the size of population, the lower the cost of providing key public goods.

In Poor quality of physical infrastructure such as access to clean water and good sanitation conditions can easily add significant cost of the population growth to the urban development. In fact, there is a thin line between significant costs and significant benefits of the population growth considering the prospects of urban development. The overall impact of the population growth on the measures of urban development can best be understood in the context of the agglomeration density of population. The growth of megacities is likely to double or triple the size of current population in large cities. In this particular framework, the quality and speed of urban development crucially depends on the set of initial conditions such as the quality of infrastructure, the percentage of the city with direct access to clean water, the quality of roads and the outlook of economic agglomeration - i.e. the concentration of similar economic activities at the same place. The economic agglomeration can greatly benefit the economic growth of cities since it encourages the patterns of specialization through economies of scale and network effects. If the quality of initial conditions is not provided to the greatest possible extent, diseconomies of agglomeration, such as population crowding and congestion can be greatly disadvantageous to the future quality of living and economic growth in megacities.

To estimate the predictive influence of the agglomeration of population on the share of population living below poverty line, I estimated the relationship between long-run densities of agglomeration, defined as the percentage of the population in urban area of more than one million, and the percentage of the population below poverty line. The purpose of the brief empirical analysis is to estimate the effect of the deviation of the percentage of population in urban settlements on the share of population below poverty line. Does the crowding of the population increase the share of poor population? I calculated the standard deviation of long-run density of population in urban agglomerations of more than one million for 20 lower-middle income countries between 1960 and 2009. The result suggests that a one percentage increase in the standard deviation of the population living in million-sized urban agglomerations increases the proportion of the population below poverty line by six percentage points, holding all other factors constant. The estimated slope coefficient is statistically significant at the 0.1 percent level, suggesting that the impact of population agglomeration in urban settlements is persistent and systematic. In addition, long-run agglomeration density of the population living in urban areas of more than one million accounts for 23 percent of the cross-country variation in the share of population below poverty line. Hence, the estimates suggest that a dispersive growth of overcrowding significantly increases the proportion of the population living in poverty. Therefore, the growth of population between 1960 and 2009 in urban settlements increased the share of poor population in countries included in the sample.

Conclusion

The growth of cities and megacities pose a significant challenge for India and other developing nations. The economic growth and projected increases in the population will strongly influence the structure of cities as well as the settlement of urban agglomerations. The possibility of negative externalities arising from the growth of cities in India is not excluded. One such negative externality is that between 1960 and 2009, a greater dispersion of the population in urban settlements of more than one million increased the proportion of the population by more than six percentage points, holding all other factors constant. If such trend persists over the long run, the share of poor population in large urban communities is likely to increase, further diminishing the prospects of economic growth and development and increasing the non-alleviated persistence of poverty. To facilitate the mitigation of negative externalities emerging from the pressure of the growth of cities and urban agglomerations, Indian policymakers should consider establishing a strong and bold system of private property rights and contract enforcement to reduce uncertainty and boost institutional confidence as to alleviate the risk of expropriation and reduce the systemic incentives to live in slum communities. The future growth of megacities and population can yield immense economic benefits resulting from agglomeration economies. In this respect, urban development cannot be enhanced without clearly defined property rights that secure the assets of India’s citizens from the risk of expropriation. In addition, high-quality infrastructure is a necessary initial condition for prospective benefits of the organic evolution of urban settlements in India.

The growth of cities and megacities pose a significant challenge for India and other developing nations. The economic growth and projected increases in the population will strongly influence the structure of cities as well as the settlement of urban agglomerations. The possibility of negative externalities arising from the growth of cities in India is not excluded. One such negative externality is that between 1960 and 2009, a greater dispersion of the population in urban settlements of more than one million increased the proportion of the population by more than six percentage points, holding all other factors constant. If such trend persists over the long run, the share of poor population in large urban communities is likely to increase, further diminishing the prospects of economic growth and development and increasing the non-alleviated persistence of poverty. To facilitate the mitigation of negative externalities emerging from the pressure of the growth of cities and urban agglomerations, Indian policymakers should consider establishing a strong and bold system of private property rights and contract enforcement to reduce uncertainty and boost institutional confidence as to alleviate the risk of expropriation and reduce the systemic incentives to live in slum communities. The future growth of megacities and population can yield immense economic benefits resulting from agglomeration economies. In this respect, urban development cannot be enhanced without clearly defined property rights that secure the assets of India’s citizens from the risk of expropriation. In addition, high-quality infrastructure is a necessary initial condition for prospective benefits of the organic evolution of urban settlements in India.

End-notes and Additional Thinking

See H. de Soto, “Law and Property Outside the West,” in M. Miles et al. (2004). The Road to Prosperity. Washington D.C: Heritage Books

See U.S. Census Bureau, International Data Base. http://www.census.gov/ipc/www/idb/informationGateway.php

(Rok Spruk graduated from the Faculty of Economics, University of Ljubljana in October 2010, majoring in International Economics. He is economics research fellow at European Enterprise Institute in Brussels. The bachelor's thesis, entitled Long-term Crisis of Pension Systems in OECD Countries, provided a thorough theoretical and empirical assessment of the unsustainability of public pension systems in developed OECD countries in the light of ageing population and rapidly growing unfunded financial liabilities of Western governments. His research interests include economic growth and development, financial macroeconomics, econometrics and public economics. Currently, he is economics research fellow at European Enterprise Institute in Brussels. He regularly discusses contemporary dilemmas of the modern world on his blog Capitalism & Freedom: http://rspruk.blogspot.com

The views expressed in the write-up are personal and do not re?ect the official policy or position of the organization.)

<

|

| |

|

| |

|

|

*

|

| Name: |

* |

| Place: |

* |

| Email: |

* *

|

| Display Email: |

|

| |

|

| Enter Image Text: |

|

| |

|