POLICY PERSPECTIVE

Multilevel Fiscal Governance in a Balanced Policy Environment

Chanchal Kumar Sharma, Associate Fellow, Centre for Multilevel Federalism (CMF), Institute of Social Sciences New Delhi 3/1/2011 6:23:07 AM

There is an intimate relationship between poverty reduction, sector performance and the institutional arrangements in federal settings. One major dilemma of fiscal federalism literature relates to the mechanism of financing subnational governments i.e. the instruments and systems used to raise revenue, and allocate funds. These mechanisms are the key determinants of the effectiveness of social service delivery in sectors such as health and education. Thus, the development of efficient fiscal federalism is the key to success of social services.

There is an intimate relationship between poverty reduction, sector performance and the institutional arrangements in federal settings. One major dilemma of fiscal federalism literature relates to the mechanism of financing subnational governments i.e. the instruments and systems used to raise revenue, and allocate funds. These mechanisms are the key determinants of the effectiveness of social service delivery in sectors such as health and education. Thus, the development of efficient fiscal federalism is the key to success of social services.

The existing literature is replete with the rhetorical emphasis on the either of the two mechanisms, that is, federal transfers and subnational tax autonomy. In fact, the problem lies in the question being asked. Instead of asking which of the two mechanisms constitutes a better approach to fiscal adjustment, the question should rather be the extent to which revenue powers (i.e., taxes and user charges) should be devolved for accountability and the extent to which federal spending powers should be maintained for efficiency and equity.

However, offering technocratic solutions is not enough. In fact, strategic behaviour of the political officials at the central and subcentral levels can create distortions in the actual operationalization of the constitutional division of powers and responsibilities leading to unintended outcomes.

Thus, in addition to a sound system of intergovernmental financial relations we also need a definite set of institutional mechanisms and procedures that can be used to get around political problems. Since these problems are related to incentives and self-interest, the need is to create a self-enforcing system with in-built incentives for self-imposed fiscal ethics whereby the political officials at the two levels, find it in their best self-interest to avoid indulging in welfare-reducing strategic behaviours, and mutual blame-shifting. In such a set of institutions both levels of government will mutually recognise the other’s comparative fiscal advantages and the limits on their legitimate spheres of action.

This paper suggests two solutions: (a) Combine subnational revenue control with fiscal equalization system in a macroframework (b) Integrate civil society, legal-institutional (arbitral institutional machinery) and political-bargaining approaches so that an independent arbitrating agency can work in cooperation with the civic organizations and collaborative intergovernmental processes to resolve fiscal imbalances.

A Balanced Perspective on Fiscal Federalism

From the national perspective on fiscal federalism, transfers are useful in their own right because they reflect “federal spending priorities” (Boadway 2005, p. 72). Transfers, in this view, enable the central government to replicate the efficiency and equity outcomes of a unitary state (Boadway and Flatters 1982; Boadway and Tremblay 2006). This approach however, can rationalise the intrusive actions by the federal government that lead to coercive fiscal relations characterised by federal pre-emption of state and local authority (see Kincaid 1990). On the other hand, the sub-national perspective on fiscal federalism goes to the other extreme and argues that transfers are weak policy instruments that sever the connection between spending and taxing authority. This perspective advocates a high degree of subnational tax autonomy (Weingast 2006) and insists that SNGs should finance their actions with their own-source tax revenues (Warren 2006, p. 49). It universally assumes that institutional mechanisms designed to grant independent revenue-raising authority to SNGs are always desirable as they will harden the budget constraint for SNGs (Rodden, Eskeland, and Litvack 2003).

The balanced perspective on fiscal federalism implies that when implemented beyond a certain limit, either policy instrument (subnational tax autonomy or transfers) can cause tensions in the federal system and result in reduced efficiency. An excess of both can create incentives for SNGs to behave irresponsibly. Weingast, Shepsle, and Johnsen (1981) and Wildasin (1997) studied the irresponsible behaviour associated with intergovernmental transfers, and Dillinger and Webb (2001) and Prud’homme (1995) highlighted the irresponsible behavioural patterns typically associated with subnational tax autonomy. SNGs with fiscal autonomy may rationally decide to under-tax and under-provide market-promoting public goods and services (ignore positive externalities). However, SNGs’ excessive reliance on federal transfers can cause negative externalities, including over-borrowing and overspending on rent seeking and corruption.

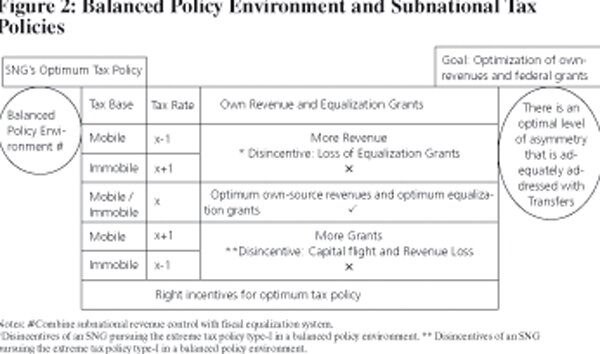

Thus, the most desirable system of allocations avoids efficiency losses, resulting from either financial dependency, or subnational fiscal operations. In fact, the emerging literature has begun to focus on combining subnational tax autonomy with a fiscal equalization system especially for enhancing welfare in markets of tax competition (e.g. Köthenbürger 2005, Bucovetsky and Smart 2006). Following the ideas contained in this genre of literature, it can be argued that a system with an optimal level of asymmetry that is adequately addressed with transfers, sets the incentives right for tax policy at SNG level.

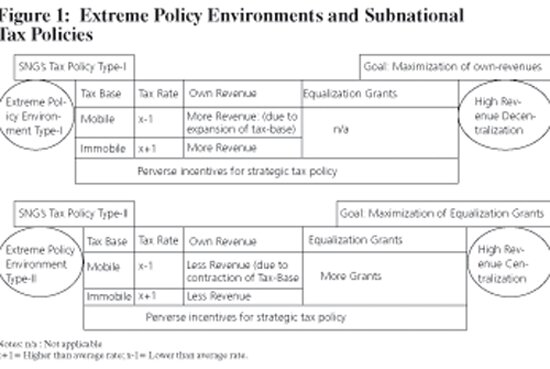

To illustrate the point, I first present a comparison of the two extreme forms of policy environments in Figure 1 and then illustrate, in Figure 2, the subnational tax policy in a balanced policy environment that combines subnational revenue control with fiscal equalization system.

A sensible assumption about subnational tax policy is that SNGs design their revenue maximizing strategies in context of their specific policy environments. I assume two extreme policy environments. In Type-I policy environment, I assume an extreme form of revenue decentralization. In this situation, SNGs face competitive incentives to increase their revenues by increasing tax rates on immobile tax bases and reducing tax rates on mobile tax bases. The latter policy will increase revenues by attracting more mobile tax bases into the jurisdiction. In Type-II policy environment, I assume an extreme form of revenue centralization. In this situation, SNGs face competitive incentives to attract more equalization grants. To accomplish this goal, they reduce their tax effort on immobile tax bases and impose high tax rates on mobile tax bases. The latter policy will decrease revenues by repelling mobile tax bases out of the jurisdiction.

Figure 2 illustrates a third type of policy environment where subnational revenue control is combined with equalization transfers. In this system, both kinds of perverse incentives will work in opposite direction leading to a classical case of multiple distortions and the second best result. In such a policy environment, if an SNG adopts extreme tax policy type-I, it will be entitled to lower equalization grants that will offset revenue gain due to inflow of the mobile tax base. The simple logic of such a system can be understood as follows: A particular region lowers its tax rate on mobile tax bases. This leads to an inflow of capital into that region, which alleviates the revenue loss on account of reduction in tax rate. However, this attempt by a region to improve its own mobile tax base causes a corresponding tax base loss from neighboring regions. Thus, tax revenues of neighbouring regions deteriorate. The net outcome is an inefficient supply of public goods. The equalization scheme then responds by lower entitlements of the tax-lowering region and higher entitlements of the other regions. Thus, an equalization system reduces pressures of tax competition and allows SNGs to set higher rates. On the other hand, if an SNG adopts extreme tax policy type-II, it will lose mobile tax base that will offset gains from more federal grants.

The Institutional Mechanisms for Optimal Fiscal Federal System

The ‘optimal asymmetry’ is variable and cannot be definitively specified for all countries, or even a particular country at all times. One country at different times and different countries at one time have different levels of ‘optimal asymmetry’. In fact, determining an ‘optimal distribution’ of taxing authority and spending responsibility is not a technical exercise because it cannot be based on some fixed universal standards of optimality. The notion of ‘optimal’ — better than any other distribution — is a relative and context-dependent concept; it is determined to a large extent by the nature of federal polity and the political consensus on policy goals.

So the question of optimality must finally be addressed politically. Yet, it cannot be the product of ad hoc political bargaining either. Some have argued that the level of state taxation in any particular country is simply determined by the political ‘equilibrium’ of that country (Diaz-Cayeros 2006). This approach tends to justify any existing level of federal transfers or subnational taxation, even if they are a product of factors, such as the relative strength of the federal government vis-à-vis SNGs, the relative bargaining power of wealthier SNGs compared to poor SNGs, and the secession threats by SNGs that aspire to sovereignty. Such equilibrium, based on pure political bargaining, can distort the welfare enhancing and efficiency rationale of a fiscal federal structure.

Furthermore, the power politics can preclude the rationalisation of the fiscal structure and can cause the allocations to lean excessively to either side of the centralization-decentralisation continuum. For example, in Russia, the government typically grants preferential fiscal agreements to the regions with the most serious separatist claims (Treisman 1999). In fact, weakening of the central government can potentially trigger the demand for more revenue authority to SNGs. This happened in Indonesia after the historic fall of the Soeharto Regime (1966–1998) in May 1998 and in Russia after ‘August 1998 meltdown’ (economic paralysis and consequent devaluation of the Rouble on 17th August 1998). This kind of decentralization is unlikely to promote a governance agenda based on transparency and accountability as is largely assumed in the neo-institutionalist perspective (see Hadiz 2004 for a critique of neo-institutionalist perspective). Hadiz (2004) draws on Indonesian experience to illustrate the way in which decentralization processes and institutions can be hijacked by a wide range of interests.

In context of such experiences, some have argued that a given combination of non-federal and federal goods can be said to be optimal if it is identical with the combination that would result if the expenditure and taxing decisions of all jurisdictions were subject to national vote. Voting can be based on the majority rule (Hartle 1971, p. 103) or on the unanimity rule (Hettich and Winer 1986, p. 749-50).

Hettich and Winer advocated the unanimity rule because it prevents special interest groups from influencing fiscal outcomes. However, since unanimous voting is not a realistic possibility, the authors recommended a requirement to make decisions by pluralities larger than 50%. Lazar et al. (2004) and Dahlby (2005) argue that VFI exists when a particular level of government complains about insufficient funding and/or tax room and a wide majority of the public supports its cause. Though a public opinion poll is a significant factor, yet it is not sufficient because political leaders can always manipulate the voters by appealing to their prejudices, their parochial feelings, and their desire for short-term gains, even at the cost of long-term gains (Chelliah 2010, p. 22).

In fact, political officials at both levels of government behave strategically, and therefore the challenge is to create self-enforcing institutions with inbuilt incentives to dissuade officials from indulging in a welfare-reducing and mutually destructive behaviour. Thus, I suggest a simultaneous co-existence of following features to maintain an optimal fiscal federal system:

i. An Independent, Arbitrating Agency /Commission: An independent agency or commission of academics and professionals can undertake research on the tax-transfer arrangement required in a particular period. Countries like Australia, India, and South Africa have such independent agencies to work out the distribution of resources between the various levels of government.

Quantifying optimality requires an objective assessment of a federal government’s resources and legitimate expenditure needs in a macro framework. However, there are reasonable differences on such assessments based on values, party politics, regional politics, and views on the nature of the federation and the economic role of government (i.e., the side one takes in intergovernmental disagreements on vertical fiscal relations).

Nevertheless, the independent agency can determine the best set of assignments by gathering feedback on several variables, including the federal government’s expenditure needs and expected revenues, the SNGs’ expenditure requirements and expected revenues, and the extent to which transfers are required to achieve equalisation and national objectives. This feedback can be obtained from election results, public opinion polls, and political debates. Additionally, the financial markets provide a constant flow of information on the relative prices of federal and provincial goods in a particular period. This information is an important indicator of the spending needs of the two levels of government.

In 2008, in response to the changing times, Australia’s Rudd Government decided to revise the country’s fiscal arrangements with the establishment of ‘The Australia's Future Tax System Review Panel’ under the Chairmanship of Dr. Ken Henry. This panel examined and made recommendations for Australia’s tax and transfer system, including state taxes.

The Review Panel provided the opportunity for the Australian people to participate by holding public meetings in all the major cities. A series of analytical papers were also commissioned to explore significant tax and transfer policy issues. The government received the report on 23rd December 2009 and is currently examining the report.

Thus, an independent agency appointed by a government can provide fiscal guidance. However, in the absence of institutions for intergovernmental interactions, risk-averse political officials will avoid difficult decisions by taking the agency’s recommendations as optional propositions. However, the creation of collaborative political processes and forums for intergovernmental interactions, as argued in the next sub-section, can produce a mutually agreed upon, politically sustainable set of assignments. The existence of vibrant civic society organisations and fiscal rules can further steer intergovernmental interactions towards welfare-enhancing outcomes.

ii. Collaborative Intergovernmental Institutions for Sustained Interactions: Public economics scholars have tried to find solutions by incorporating cooperation into the fiscal structure itself. This suggestion, called co-occupancy, is often proposed for systems in which both levels of government jointly tax in the spirit of cooperative federalism. It is generally believed that co-occupancy minimises the effects of tax disharmony, which is associated with tax separation. Boadway and Tremblay (2006) however, explicitly identified the lack of intergovernmental cooperation as a source of VFI, even in cases of joint taxation.

Boadway and Tremblay (2006) analyze two forms of vertical externalities. One, if SNGs are aware that federal government cannot commit to a level of transfers that is chosen before their spending decisions, they just anticipate that the federal government will finance their expenditures. Thus they set their tax rates too low and spending too high. Second, if federal government is able to commit to a transfer policy, SNGs, concentrate on tax policy. They perceive that increase in tax rate by either level, will reduce the co-occupied tax base. This means part of the cost of rise in subnational tax rate will fall on the federal government. Thus SNGs, acting on behalf of their own residents, fail to take into account the full cost of increase in tax rate, to the nation as a whole. Thus tax rates are set too high.

Rodden and Wibbels (2002) analyze the tendency of SNGs to impose new priorities just to attract more transfers even when national level is under funding old commitments. They demonstrated that a lack of intergovernmental cooperation can lead to a “vertical war of attrition”, in which provincial and central officials attempt to shift fiscal burdens onto the other instead of implementing difficult adjustment measures.

The above discussion indicates that the solution should be sought in the political arena. The institutions for sustained intergovernmental interactions can prove to governments that having sound public finances is in their best self-interests and that both levels of government should work as equal partners for co-production of policies. The Nobel laureate Thomas Schelling (1956) noted that if the parties take a long term perspective and do in fact interact repeatedly, their common interests may be sufficiently strong to sustain cooperation. Such an extended interaction can reduce the incentive to behave opportunistically. Fourçans and Thierry (2001) use game theory to argue that ‘infinite interactions’ prevent welfare-reducing strategic behaviours. Using a game theory model to analyse the European tax situation, Fourçans and Thierry argue, "It is of a paramount importance for a country to be able to give a strong signal to the other country that a war of attrition is possible. For that, countries must have sound public finances" (p. 17).

Arora et al. (2008) have drawn attention to the need for greater ‘interactions in federal systems’. “Interaction involves a greater degree of interdependence between spheres than the simple model of distribution of powers suggests.” (Ibid p.4). In fact, as the dividing line between public and private is getting blurred, the government at all levels — central, regional and local — is increasingly becoming a co-producer of policies together with the private sector. Thus, the changed context has made the creation of ‘interactive networks of stakeholders’ an interesting policy option.

This idea supplements the insights from the literature on ‘policy networks’ — an idea rooted in political science literature on intergovernmental relations (see Rhodes 1998, 99). These ideas can be useful in modeling vertical and horizontal interactions and linkage mechanisms among the stakeholders. Although the prisoner’s dilemma suggests that voluntary co-operation is implausible, ‘policy networks’ can facilitate infinite interactions that reveal interdependencies and induce cooperative behaviour.

A well-guided rationale can even reveal to rich SNGs that it is in their long-term interests to make voluntary transfers to poor SNGs. Myers (1990), for instance, demonstrated that such contributions can benefit rich SNGs’ economies by discouraging inefficient regional migration. Thus, the collaborative intergovernmental processes for sustained interactions can prevent assignments from emerging on the basis of pure political bargaining, which is detrimentally informal and ad hoc.

iii. Civic Society Organisations: Civic society organisations can serve to generate and disseminate information about service delivery, with the specific purpose of verifying political promises and mobilizing voters in the area of public service provision (see Keefer and Khemani 2005). This suggestion rests on the assumption that politicians in all countries respect interests that can bring voters to polls. Thus, disseminating information among voters on the performance of public services and mobilizing them to hold political agents accountable can encourage the political officials to improve public service delivery. Civic society organisations can play such a role. Reinikka and Svensson (2004) showed that in Uganda information dissemination strategy had a substantial impact in preventing leakage of funds away from purposes intended in public budgets.

iv. Legislated Fiscal Rules or Fiscal Councils: Legislated fiscal rules or Fiscal Councils can serve to enforce rule based fiscal discipline. This suggestion is based on international experience, as illustrated by Shah (2006) and (Debrun, Hauner, and Kumar 2009). The experience in Brazil, India, Russia, and South Africa supports the possibility that legislated fiscal rules in the form of budgetary balance controls, debt restrictions, tax or expenditure controls, and referenda for new taxation and spending initiatives can restrain pork-barrel politics and improve fiscal discipline (Shah 2006). In fact, most U.S. states have legislative mechanisms to restrict unrestrained spending like balanced budget laws. Similarly, several Canadian provinces have introduced balanced budget legislation to discourage deficit financing. Furthermore, the success of ‘fiscal councils’ in Belgium, Denmark, and Sweden in ensuring fiscal discipline by providing independent assessments demonstrates that such institutions can reinforce government’s commitments to fiscal responsibility by raising the political costs of deviation (Debrun, Hauner, and Kumar 2009). For a review of the rationale for fiscal rules and the advantages and drawbacks associated with them, see Kennedy and Robbins (2003).

iv. Legislated Fiscal Rules or Fiscal Councils: Legislated fiscal rules or Fiscal Councils can serve to enforce rule based fiscal discipline. This suggestion is based on international experience, as illustrated by Shah (2006) and (Debrun, Hauner, and Kumar 2009). The experience in Brazil, India, Russia, and South Africa supports the possibility that legislated fiscal rules in the form of budgetary balance controls, debt restrictions, tax or expenditure controls, and referenda for new taxation and spending initiatives can restrain pork-barrel politics and improve fiscal discipline (Shah 2006). In fact, most U.S. states have legislative mechanisms to restrict unrestrained spending like balanced budget laws. Similarly, several Canadian provinces have introduced balanced budget legislation to discourage deficit financing. Furthermore, the success of ‘fiscal councils’ in Belgium, Denmark, and Sweden in ensuring fiscal discipline by providing independent assessments demonstrates that such institutions can reinforce government’s commitments to fiscal responsibility by raising the political costs of deviation (Debrun, Hauner, and Kumar 2009). For a review of the rationale for fiscal rules and the advantages and drawbacks associated with them, see Kennedy and Robbins (2003).

Thus, civil society, legal-institutional and political-bargaining approaches should be combined to eliminate the possibility of distortion of fiscal outcomes by ad hoc political bargaining or by welfare-reducing strategic behaviour by governments. To be consistent with a political economy approach, this solution is based on incentives and self-interest. The bottom-line is that intergovernmental fiscal arrangements must result from equal negotiations between the levels of government and must always aim at achieving maximum public welfare. In order to protect the public welfare, the negotiating process must engage the non-government stake holders, because federal governance is not the exclusive preserve of government; there are other agencies like private sector and civil society organizations that are involved in governing a federal social order.

References and Additional Thinking

• Arora, B., B. Radin, and C. Saunders. 2008. ‘Interactions in Federal Systems’, in J. Kinciad and R. Chattopadhyay (eds), Unity in Diversity: Learning from Each Other (Vol 3). New Delhi: Viva Books, pp. 3-24.

• Boadway, R. 2005. ‘The Vertical Fiscal Gap: Conceptions and Misconceptions’, in Harvey Lazar (ed.), Canadian Fiscal Arrangements: What Works, What Might Work Better. Montreal and Kingston: McGill-Queen’s Press, pp. 51–80.

• Boadway, R. and F. Flatters. 1982. Equalization in a Federal State: An Economic Analysis. Ottawa: Economic Council of Canada.

• Boadway, R. and J. Tremblay. 2006. ‘A Theory of Fiscal Imbalance’, FinanzArchiv, 62, 1, 1–27.

• Bucovetsky, S. and M. Smart. 2006. ‘The Efficiency Consequences of Local Revenue Equalization: Tax Competition and Tax Distortions’, Journal of Public Economic Theory 8, 1, 119-144.

• Chelliah, R. J. 2010. Political Economy of Poverty Reduction in India. New Delhi: Sage.

• Dahlby, B. 2005. Dealing with the Fiscal Imbalances: Vertical, Horizontal and Structural. Toronto: C.D. Howe Institute.

• Debrun, X., D. Hauner, and M. Kumar. 2009. ‘Independent Fiscal Agencies’, Journal of Economic Surveys 23(1): 44-81.

• Diaz-Cayeros, A. 2006. Federalism, Fiscal Authority, and Centralization in Latin America. New York: Cambridge University Press.

• Dillinger, W., and S. Webb. 2001. Fiscal Management in Federal Democracies: Argentina and Brazil. Washington, DC: World Bank.

• Fourçans, A. and W. Thierry. 2001. ‘Tax Harmonization versus Tax Competition in Europe: A Game Theoretical Approach’, CREFE Working Paper No:132. Montreal, Canada: Université du Québec à Montréal.

• Hartle, D. G. 1971. ‘The impact of new tax policies on national unity’, in Advisory Commission on Intergovernmental Relations, In Search of Balance — Canada’s Intergovernmental experience. Washington DC.

• Hettich, W. and S. Winer. 1986. ‘Vertical Imbalance in the Fiscal Systems of Federal States’, Canadian Journal of Economics, 19, 4, 745-65.

• Keefer, P. and S. Khemani. 2005. ‘Democracy, Public Expenditures, and the Poor’, World Bank Research Observer, 20, 1, 1-27.

• Kennedy, S. and J. Robbins 2003. ‘The Role of Fiscal Rules in Determining Fiscal Performance’, Finance Canada Working Paper, 2001-16.

• Kincaid, J. 1990. ‘From Cooperative to Coercive Federalism’, Annals of the American Academy of Political and Social Science, 509, 1, 139 – 52.

• Köthenbürger, M. 2005. ‘Leviathans, Federal transfers, and the Cartelization Hypothesis’, Public Choice, 122, 3, 449-65.

• Lazar, H., F. St-Hilaire and J.F.Tremblay. 2004. ‘Vertical Fiscal Imbalance: Myth or Reality’, in H. Lazar and F. St-Hilaire (eds), Money, Politics and Health Care: Reconstructing the Federal-Provincial Partnership. Montreal & Kingston: McGill Queens University Press, pp. 135-87.

• Myers, G. 1990. ‘Optimality, Free Mobility and the Regional Authority in a Federation’, Journal of Public Economics, 43, 1, 127-41.

• Prud’homme, R. 1995. ‘On the Dangers of Decentralization’, World Bank Research Observer, 10, 2, 201-20.

• Reinikka, R. and S. Jakob. 2004. ‘Local Capture: Evidence from a Central Government Transfer Program in Uganda’, The Quarterly Journal of Economics 119, 2, 679-706.

• Rhodes, R. A. W. 1998. ‘Different roads to unfamiliar places: UK experience in comparative perspective’, Australian Journal of Public Administration 57, 19–31.

• Rhodes, R. A. W. 1999. Control and power in Central-Local Government Relationships. Aldershot: Ashgate.

• Rodden, J. and E. Wibbels. 2002. ‘Beyond the Fiction of Federalism: Macroeconomic Management in Multi-tiered Systems’, World Politics, 54, 4, 494-531.

• Rodden, J., G. Eskeland, and J. Litvack. 2003. Fiscal Decentralization and the Challenge of Hard Budget Constraints. Cambridge Massachusetts :The MIT Press.

• Schelling T.C. 1956. ‘An essay on bargaining’, American Economic Review, 46, 281-306.

• Shah, A. 2006. ‘Comparative Re?ections on Emerging Challenges in Fiscal Federalism’, in Raoul Blindenbacher and Abigail Ostien Karos (eds), Dialogues on the Practice of Fiscal Federalism. Montreal:McGill-Queen’s University Press, pp. 40–46.

• Treisman, D. 1999. After the Deluge: Regional Crises and Political Consolidation in Russia. Ann Arbor: University of Michigan Press.

• Warren, N. 2006. ‘Benchmarking Australia’s Intergovernmental Fiscal Arrangements: Final Report’, available at www.treasury.nsw.gov.au.

• Weingast, B. R. 2006. ‘Second-Generation Fiscal Federalism: Implications for Decentralized Democratic Governance and Economic Development’, Hoover Institution Working Paper, June.

• Weingast, B. R., K. A. Shepsle, and C. Johnsen. 1981. ‘The Political Economy of Benefits and Costs; A Neoclassical Approach to Distributive Politics’, Journal of Political Economy, 89, 4, 642-64.

• Wildasin, David E. (Ed.). (1997). Fiscal aspects of evolving federations. New York: Cambridge University Press.

(Dr. Chanchal Kumar Sharma is Associate Fellow at the Centre for Multilevel Federalism (CMF), Institute of Social Sciences, New Delhi. He is the author of 10 research papers, seven newspaper and magazine articles, and six text book chapters, the most recent of which is “Beyond Gaps and Imbalances: Restructuring the Debate on Intergovernmental Fiscal Relations” forthcoming in Public Administration (Blackwell, Oxford). His paper on Haryana Tourism published in Tourism (Zagreb, Croatia) was declared among top 10 papers for EIBSTR:Public/Private Partnerships in 2007. Besides these, his papers have appeared in Globalization (Athabasca University, Canada), Loyola Journal of Social Sciences, Indian Journal of Federal Studies (Hamdard University), Indian Journal of Political Science, Sajosps and Synthesis. He is on the editorial board of South Asian Journal of Socio-political Studies and Arya Bhatta Journal of Mathematics and Informatics. He earned his M.A and M. Phil in Political Science from Jawaharlal Nehru University, New Delhi and his Ph.D. from Kurukshetra University Kurukshetra (Haryana). He teaches Political Science, at M.A. College, Jagadhri, Kurukshetra University.

The author thanks Prof. Robin Boadway and Prof. Balveer Arora for comments on an earlier draft of this paper. The views expressed in the write-up are personal and do not re?ect the official policy or position of the organization.)

<

|

| |

|

| |

|

|

*

|

| Name: |

* |

| Place: |

* |

| Email: |

* *

|

| Display Email: |

|

| |

|

| Enter Image Text: |

|

| |

|