INCLUSIVE INDIA

Financial Inclusion: A Viable Option for Inclusive Growth

Ameet Banerjee, Faculty, Institute of Development Studies, Lucknow University Formerly — Dean (Academics), IBS and Ex-Banker 3/1/2011 11:43:25 PM

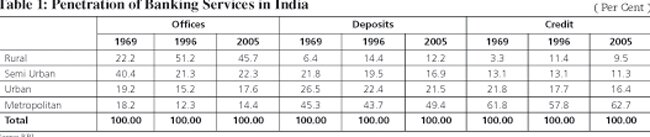

The theme of the paper is to understand the inter- relation between financial inclusion and its overall contribution to economic growth and the impediments to financial inclusion in Indian scenario and what needs to be done to encompass all those financially excluded into the folds of inclusive class. Financial inclusion has much wider perspective not confined to bare minimum access to no frill accounts but on a larger canvas it is to deliver affordable financial services to vast section of the society, devoid of any disparities in income and other social structures. As its’ a fact that one segment is deluged with assortments of banking services encircling regular banking facilities, portfolio counseling on the other end — a class of underprivileged and lower income group are totally deride of even basic financial services. Though the banking industry has grown both horizontally and vertically but the branch penetration has not been that enthusiastic with population load even after passing decades of nationalization, whose rationale was to shift the focus from class banking to mass banking. And given the demographic dynamics in Indian context the complexities are further aggravated, which calls for multi-level, multi-dimensional framework to address the issues relating to financial inclusion.

The theme of the paper is to understand the inter- relation between financial inclusion and its overall contribution to economic growth and the impediments to financial inclusion in Indian scenario and what needs to be done to encompass all those financially excluded into the folds of inclusive class. Financial inclusion has much wider perspective not confined to bare minimum access to no frill accounts but on a larger canvas it is to deliver affordable financial services to vast section of the society, devoid of any disparities in income and other social structures. As its’ a fact that one segment is deluged with assortments of banking services encircling regular banking facilities, portfolio counseling on the other end — a class of underprivileged and lower income group are totally deride of even basic financial services. Though the banking industry has grown both horizontally and vertically but the branch penetration has not been that enthusiastic with population load even after passing decades of nationalization, whose rationale was to shift the focus from class banking to mass banking. And given the demographic dynamics in Indian context the complexities are further aggravated, which calls for multi-level, multi-dimensional framework to address the issues relating to financial inclusion.

Rangarajan Committee (2008) viewed financial inclusion as “The process of ensuring access to financial services and timely and adequate credit where needed by vulnerable groups such as weaker sections and low income groups at an affordable cost”. All efforts made to encourage financial inclusion will turn futile, unless the deprived class is brought into mainstream banking and channelizing banking services to diverse class of the society whose 37.2% population (as per Tendulkar Committee Report) reeling under poverty with majority contribution is from the rural belt will be daunting challenge which needs spirited policy adjustments, innovation in product dynamics, proficient human resource and technological circumvention at all levels to marginalize the hiatus. A conventional and unconventional measures needs to be advocated as orthodox banking practices will head nowhere in breaking the bottlenecks faced at the grass root level.

Rangarajan Committee (2008) viewed financial inclusion as “The process of ensuring access to financial services and timely and adequate credit where needed by vulnerable groups such as weaker sections and low income groups at an affordable cost”. All efforts made to encourage financial inclusion will turn futile, unless the deprived class is brought into mainstream banking and channelizing banking services to diverse class of the society whose 37.2% population (as per Tendulkar Committee Report) reeling under poverty with majority contribution is from the rural belt will be daunting challenge which needs spirited policy adjustments, innovation in product dynamics, proficient human resource and technological circumvention at all levels to marginalize the hiatus. A conventional and unconventional measures needs to be advocated as orthodox banking practices will head nowhere in breaking the bottlenecks faced at the grass root level.

Why Speaking about Financial Inclusion

It is imperative that inclusive growth without financial inclusion will not succeed in achieving equitable objectives as financial  inclusion can truly fortify the economic standards of the poor and the disadvantaged whose enrichment is foremost prerequisite for a nation encumbering growth trajectory. And the issue is aptly discussed in academic literature that there exists a correlation between financial development and economic growth. And when we are in the process of annexing second generation reforms one cannot imagine that a third of the population is under poverty level. Here financial inclusion will help in striking a balance by channelizing the surplus to deficit units and bring them under the growth metaphor. The more the development larger is the thrust on empowering the low income group. And with experiences of Grameen Bank (Bangladesh) has brought a new paradigm to the banking practices by changing the perception that poor are bankable and given a direction for the world community for diffusing of banking services and a business model which is highly rated and most valued.

inclusion can truly fortify the economic standards of the poor and the disadvantaged whose enrichment is foremost prerequisite for a nation encumbering growth trajectory. And the issue is aptly discussed in academic literature that there exists a correlation between financial development and economic growth. And when we are in the process of annexing second generation reforms one cannot imagine that a third of the population is under poverty level. Here financial inclusion will help in striking a balance by channelizing the surplus to deficit units and bring them under the growth metaphor. The more the development larger is the thrust on empowering the low income group. And with experiences of Grameen Bank (Bangladesh) has brought a new paradigm to the banking practices by changing the perception that poor are bankable and given a direction for the world community for diffusing of banking services and a business model which is highly rated and most valued.

Efforts Made for Financial Inclusion

Time and again Government of India and Reserve Bank of India were proactive in order to augment the banking penetration. Some of efforts made in this direction were facilitate the co-operative Movement; Setting up of State Bank of India ; Nationalization of banks in two phase one in 1969 and the other being 1980; initiation of Lead Bank Scheme ; establishment of RRBs (Regional Rural Banks); Service Area Approach; introducing Self Help Group – Bank Linkage programme. Moreover the government has emphasized it’s explicitly the need for overall inclusion in the development process through its MGNREGS, Bharat Nirman Programme.

Time and again Government of India and Reserve Bank of India were proactive in order to augment the banking penetration. Some of efforts made in this direction were facilitate the co-operative Movement; Setting up of State Bank of India ; Nationalization of banks in two phase one in 1969 and the other being 1980; initiation of Lead Bank Scheme ; establishment of RRBs (Regional Rural Banks); Service Area Approach; introducing Self Help Group – Bank Linkage programme. Moreover the government has emphasized it’s explicitly the need for overall inclusion in the development process through its MGNREGS, Bharat Nirman Programme.

RBI's Contribution

Banks were given direction to make available no-Frill Accounts by RBI in November 2005 to expand outreach of such accounts to major sections of the society. Simplification of KYC norms for low income group. One of the pivotal developments being banks were permitted to avail the services of NGOs / SHG, micro finance institutions and other financial

intermediaries to facilitate the banking services under BC / BF Model. Simplification of guidelines under KCC / GCC scheme in rural areas enabling customers’ easy access to credit and mechanism for one time settlement of loans with principal amount up to Rs. 25,000 which have turned doubtful or non performing asset. Loans granted under Government sponsored schemes were advised to frame separate guidelines following a state specific approach evolved by the SLBC. Liberalized regime for branch expansion and setting up of ATMs. Introduction of technology products and services like Mobile Banking, Biometric ATMs, Mobile ATMs etc. Allowing RRBs’ and Co-operative banks to sell Insurance and Financial Products under bank assurance channel. Promotion of financial literacy program and creation of special funds.

What has been Achieved?

• 431 districts identified by the SLBC convenor banks for 100 percent financial inclusion across various States/UTs and the target in 204 districts of 21 States and seven UTs has reportedly been achieved.

• Number of No-Frill Accounts — 28.23 million (as on December 31, 2008).

• Number of rural bank branches — 31,727 constituting 39.7% of total bank branches (as on May 31, 2009)..

• Number of ATMs — 44,857 (as on May 31, 2009).

• Number of POS — 4,70,237 (as on May 31, 2009).

• Number of Cards — 167.09 million (as on May 31, 2009).

• Number of Kisan Credit cards — 87.83 million (Source: NABARD).

• Number of Mobile phones — 403 million (as on April 30, 2009) — out of which 187 million (46%) do not have a bank account.

Shortcomings

Lack of Financial Literacy: Low literacy rate has been a great impediment for financial inclusion as ignorance caused low levels of awareness causing difficulty to communicate the necessity for banking habits and what savings can do to enrich their living standards. With little knowledge it turns out to be difficult task to make them understand the product features and second the complex legal terminologies.

Gap in Technology: Next generation of banking is era of technology, an inevitable source to improve branch infrastructure in terms of usage, increase outreach and help in scaling up activities. With growing spread in clientele and the need for servicing them once the relationship is established will call for low cost delivery alternatives and technology can be leveraged to increase delivery channels at lower cost, have better internal controls, augment the competency, safety and reliability of the payments and remittances system and develop a credit information system for future requirements. IT can reduce cost and time in processing of applications, maintaining and reconciliation of accounts and enable banks to use their staff at branches for making that critical minimum effort in sustaining relationship especially with new accountholders.

Language Barrier: One of the major hitch in financial inclusion being non availability of printed literature in regional vernaculars which is otherwise a prerequisite for reaching the masses. Thus a barrier is immediately created for communicating the need for inculcating banking practices. As most of the literature in the banking industry are in bilingual mode (Hindi / English), with large demographic spread are habitually jeopardize by the ignorance of language which creating a fear psychosis. As it’s often found that language is a mode by which people try to identify and connect one self. Here every possible effort should be made to present printed literature in regional languages so that the message can be delivered in a larger vein thereby attracting people from all walks of life. Though the procedure will attract lot of man — hours, language authenticity and expensive printing expenditure but in the long run it will be highly beneficial in cutting across the myth and create a social relevance of inclusion and contributing to nation’s development.

Trained and Compassionate Manpower: Human resource has been the crux for successful endeavors. In all counts trained manpower is a versatile asset which can be harnessed to achieve visionary goals. This has been the void that needs to be plugged from the grass root level as found most of the staff are either semi skilled or trained only for performing regular banking activities, but what needed is versatile manpower with a human touch who can feel the pulse of the consumers and shifting gears as according to circumstances.

Trained and Compassionate Manpower: Human resource has been the crux for successful endeavors. In all counts trained manpower is a versatile asset which can be harnessed to achieve visionary goals. This has been the void that needs to be plugged from the grass root level as found most of the staff are either semi skilled or trained only for performing regular banking activities, but what needed is versatile manpower with a human touch who can feel the pulse of the consumers and shifting gears as according to circumstances.

Statutory Documental Requirements: The necessity for simplifying the documentation procedures in opening a SB account is utmost prerequisite (KYC Norms) as people from both urban and rural belt with low incomes face problem when they approach banks or in turn are approached by the banks or financial service provider for opening accounts. RBI should set guidelines for alternative mode of identification as the essence of Know Your Customer is to identify a person by profession and class and second prevent any unforeseen event harming the interest of the nation. In case of rural belt the help of Gram Pradhan or Sarpanch (Village Head) can be used to identify a person if a document can be issued in his or her name stating his or her credentials it can be taken as viable document. Eccentric practices needs to be advocated otherwise the vision reaching the mass with banking services will receive a setback.

Lack of Customized Products: As people differ in their perception, opinions and thoughts so does their needs. The banking industry has to understand this basic philosophy and develop customer centric innovative products. The whole banking industry is offering generic products matching the needs of urbanized population and arsenal of other services where as the unbanked still remains to see the light of the dawn.

Infrastructural Requirements: With the liberalization branch opening under new branch authorization policy of RBI which encourages the opening of branches in under banked or unbanked areas. But they are still excluded population in all the parts of the country stretching from North- Eastern Belt, the Eastern and Central zone. Infrastructural deployments are not that enthusiastic to run even a satellite operation which requires power, telecommunication services and roads for geographical access. Though, under RIDF scheme government a corpus of 4,500 crore has been raised for partly funding the rural roads and bridges components of the Bharat Nirman Programme for the period 2009-10. But lot of grounds needs to be covered in this area and a required blue print for future endeavors.

Transaction Cost Too High: The assumption offering basic banking services to under privileged and low income group will not be viable and incur additional burden for up-scaling and capacity building is a myopic vision the experiences of banking industry world over and with award winning Nobel Laureate Md. Yunus modeling of Grameen Bank is an unparallel example delineating that economically backwards are bankable and the venture serves dual purpose one in financial inclusion second raising their financial standards. And regarding the high transaction cost, the cost can be averaged among the populace and technological innovations in IT services will help to build low cost service modules to support the backend operations.

Lack of Interest / Involvement of Big Technology Players: It is highly disappointing that big technological vendors showing meager interest in joining hands with banks to evolve business solution which has universal application. The challenge will lie in developing low cost alternatives for mass markets. With participation from biggies with superior technology can easily blend with the constraints can develop platform for mass scale operation and as for the cost involved for research and development which can be shared by forming a consortium were Government of India can also be participant. Strong Collaboration among Banks, Technical Service Provider is very essential in this direction.

Suggestive Line Action

Technological Intervention: Rural belts are poorly connected and customers needs to be drawn into the system as under privilege and low income groups are in the pursuits of daily employment and hence it call banks to make extra efforts to reach them through a variety of devices like branch on wheels concept, Biometric ATMs and using mobile phones as a platform for banking transactions as the penetration in both urban and even in rural areas has surpassed expectations. Biometric voice interactive Hand held devices backed by technical support rendered by telecom service provider can be effective instrument for banking in unbanked areas for real time settlements at extreme low cost. Once the data base and track record is established then an array of financial services can be offered apart from general banking transactions like utility payments, loans and insurance products. Technology will open new frontiers for financial inclusion and offer a huge potential in terms of business and banks therefore need to take aggressive steps to use technology, as a mechanism to exploit potentials in innovative and creative manner. In fact technology is critical block for future endeavors apart from providing operational support, to building massive database for referrals, reducing the transaction cost and valuable man hours.

Technological Intervention: Rural belts are poorly connected and customers needs to be drawn into the system as under privilege and low income groups are in the pursuits of daily employment and hence it call banks to make extra efforts to reach them through a variety of devices like branch on wheels concept, Biometric ATMs and using mobile phones as a platform for banking transactions as the penetration in both urban and even in rural areas has surpassed expectations. Biometric voice interactive Hand held devices backed by technical support rendered by telecom service provider can be effective instrument for banking in unbanked areas for real time settlements at extreme low cost. Once the data base and track record is established then an array of financial services can be offered apart from general banking transactions like utility payments, loans and insurance products. Technology will open new frontiers for financial inclusion and offer a huge potential in terms of business and banks therefore need to take aggressive steps to use technology, as a mechanism to exploit potentials in innovative and creative manner. In fact technology is critical block for future endeavors apart from providing operational support, to building massive database for referrals, reducing the transaction cost and valuable man hours.

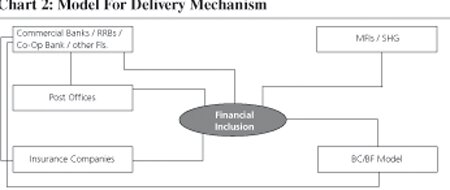

Efficient Delivery Mechanism: The use of intermediaries will only augment the process of financial inclusion by connecting people to banks. And the involvement SHG, community leaders and especially the state-level administration at grass-root level (PRIs) in India would bolster the concept of door step banking and enable effective penetration into under-served areas. Focus should be to synergize the local entities with the broad based goals for improving bankable activities and up-scaling this program for financing productive actions. While up-scaling the SHG–bank linkage program, care needs be taken to identify the group, ensure their integrity and their reputation before exercising the project. Up-scaling additionally call for knowledge enhancement and capacity building. Though Khan Committee spelt out the agent related risk in the CGAP paper but on the contrary intermediaries functionaries enables risk reduction where the group is disciplined and social capital acts as credit enhancements. Banks should enter into agreement with postal authorities to use their wide area network and reach of post offices as business correspondents to outreach the masses by leveraging the proximity of the postman to the local population, his intimate knowledge of their backgrounds and the trust reposed on him.

Proactive involvement of RBI is required when such unconventional mode operandi is facilitated. RBI should set framework on use of business correspondents and facilitators as outsourcing agents and review the process in regular basis to provide solidity. The use of MFIs as indirect mode for credit disbursals to large segment of poor and needy customers can add another dimension one helping banks to minimize credit risk and the second social upliftment.

Spreading Financial Literacy: An aggressive drive is recommended to raise literacy standards to spread financial literacy “which is a mechanism by which an individual can understand the concepts and risks embedded in a financial product and develop skill to build confidence and identify the potential financial hazards and prospects to make informed choices to improve economic standards”. The context of financial education has a broader understanding which involves understanding the behavioral and psychological factors which is innate to an individual which could be major barriers. Thus promoting intensive awareness by adult education programme, enacting village stage shows, public campaigns, usage of mobiles phones, using electronic media for promoting innovative advertisements, village panchayats, local school masters, and platforms like e-choupal and Srei Sahay can provide extra edge to reach the goal. Banks should avail the support of social organizations and village leaders who are well informed and undergone schooling to spread the need of joining the mainstream and remove any unnecessary fear housing in their minds.

Spreading Financial Literacy: An aggressive drive is recommended to raise literacy standards to spread financial literacy “which is a mechanism by which an individual can understand the concepts and risks embedded in a financial product and develop skill to build confidence and identify the potential financial hazards and prospects to make informed choices to improve economic standards”. The context of financial education has a broader understanding which involves understanding the behavioral and psychological factors which is innate to an individual which could be major barriers. Thus promoting intensive awareness by adult education programme, enacting village stage shows, public campaigns, usage of mobiles phones, using electronic media for promoting innovative advertisements, village panchayats, local school masters, and platforms like e-choupal and Srei Sahay can provide extra edge to reach the goal. Banks should avail the support of social organizations and village leaders who are well informed and undergone schooling to spread the need of joining the mainstream and remove any unnecessary fear housing in their minds.

Product Innovation: Mere offering a no frill account may help in so called to realize to increase the number of accounts but in holistic term there will be a big void in terms of financial inclusion. Financial inclusion is not limited to only opening saving bank account with zero balance facility but it means to offer a wide array of financial services from credit counseling, offering insurance and MF products, remittances facility etc. There is dearth in innovation in developing tailored made products to appeal various classes according to their individual requirements. Product innovation will help in great way in spreading financial deepening as it will be easy to approach masses and provide easy solutions. Just imagine to package SB account with Rs. 50,000 accidental policy embedded into it extending protection against mishap or daily collection saving account with daily deposit ranging from Rs. 1 to 10 depending on financial capacity ideal for BC/BF model. Offering daily deposit SB account with added with Life insurance protection with collection of Rs. 10 per day and out of which Rs. 2 can be earmarked for policy premium. On the similar lines products for credit can also be develop to accommodate the credit requirements.

Appropriate Business Model Yet to Evolve: Appropriate strategies and business model needs to be developed as penetration in rural belts and low income urban and semi urban population is altogether a different challenge. Here traditional mode of banking will be highly unsuccessful first owing to the fear psychosis, lack of financial literacy, low propensity to save among low income group but not saving with financial institutions or practically no saving habits, seasonal employment or unemployment, lack of proper credentials to support KYC norms etc. Unconventional business modeling needs to be advocated which will require attitude, will power and support from government machineries.

Appropriate Business Model Yet to Evolve: Appropriate strategies and business model needs to be developed as penetration in rural belts and low income urban and semi urban population is altogether a different challenge. Here traditional mode of banking will be highly unsuccessful first owing to the fear psychosis, lack of financial literacy, low propensity to save among low income group but not saving with financial institutions or practically no saving habits, seasonal employment or unemployment, lack of proper credentials to support KYC norms etc. Unconventional business modeling needs to be advocated which will require attitude, will power and support from government machineries.

Regulatory and Policy Interventions: RBI cannot just remain a regulatory body but has a huge responsibility in Indian context with respect to financial inclusion. Necessary legislation and guidelines can be enacted at any point of time but implementing those measures with other participants is where the challenge lies. RBI needs to regularly monitor whether the financial institutions are adhering to the commitments made both to Government and the public. Mere formulation of policies and half hearted efforts will not help the cause. Single minded focus, diligent efforts and involvement of all is the prerequisite for financial inclusion. Setting standards and bench-marking for target achievement and rewarding the institutions for their excellent delivery in way motivate others to join the social and economic cause.

Conclusion

The economy is in the path of growth trajectory and with vibrancy in all round economic activities as well as creation of new activities apart from a lean period of 18 months resulting from the global turmoil the economy resilience needs to be appreciated. The main driver being the manufacturing sector which grew at 16.3% in the last quarter, mining 14% (Q4) and the overall GDP growth was 7.4% in the year 2009-10 only China surpassed with higher growth rate at 11.9% in the January–March quarter whereas rest of the word are witnessing fragile recovery aftermath the global financial crises. At present the financial depth in Indian scenario is not that encouraging against Asian countries though it has gained momentum. As deepening financial system and widening its reach is crucial in terms accelerating the growth and achieve equitable objectives. With sudden burst in entrepreneur drive across the country will require additional financial support to nurture them. With pressure for credit delivery will need to mobilize additional resources from a wider deposit base. Thus financial inclusion will help strengthen financial deepening and enable resource mobilization for extending and broadening credit leading to economic development and accelerate growth.

The economy is in the path of growth trajectory and with vibrancy in all round economic activities as well as creation of new activities apart from a lean period of 18 months resulting from the global turmoil the economy resilience needs to be appreciated. The main driver being the manufacturing sector which grew at 16.3% in the last quarter, mining 14% (Q4) and the overall GDP growth was 7.4% in the year 2009-10 only China surpassed with higher growth rate at 11.9% in the January–March quarter whereas rest of the word are witnessing fragile recovery aftermath the global financial crises. At present the financial depth in Indian scenario is not that encouraging against Asian countries though it has gained momentum. As deepening financial system and widening its reach is crucial in terms accelerating the growth and achieve equitable objectives. With sudden burst in entrepreneur drive across the country will require additional financial support to nurture them. With pressure for credit delivery will need to mobilize additional resources from a wider deposit base. Thus financial inclusion will help strengthen financial deepening and enable resource mobilization for extending and broadening credit leading to economic development and accelerate growth.

Reference and Additional Thinking

• Government of India : Economy Survey.

• Rakesh Mohan ( 2002, 04) : Transformation of Indian Banking: In search for better tomorrow

• Inclusive growth : The Role of financial education by Shyamala Gopinath, Dy. Governor of RBI.

• Report from World Bank on Financial Inclusion.

• Kempson. E (2006) Policy Level Response to financial exclusion in developed economies.

• Rakesh Mohan ( 2006 ) Economic Growth, Financial deepening and Financial Inclusion.

• V. Leeladhar : Taking Banking services to the common Man — Financial Inclusion.

• Will Paxton (2002), Exclusion Zone.

(Prof. Ameet Banerjee is a faculty at Institute of Development Studies, Lucknow University and IIPM Lucknow. Until recently, he was the Dean (Academics) at IBS, Lucknow. He has also worked as a Regional Head at Bank of Bahrain and Kuwait BSC. His special focus area is Retail Banking. He was awarded for presenting papers at National Seminar at IDS, Lucknow.

The views expressed in the write-up are personal and do not re?ect the official policy or position of the organization.)

<

|

| |

|

| |

|

|

*

|

| Name: |

* |

| Place: |

* |

| Email: |

* *

|

| Display Email: |

|

| |

|

| Enter Image Text: |

|

| |

|