GROWTH OR DEVELOPMENT

A Path to Sustainable Development

G. Bhalachandran, Department of Economics, Department of Economics, Higher Learning, Prasanthinilayam 5/30/2011 3:39:27 AM

Intel, Google, Apple, Facebook, Digital Equipment Corporation, Genentech, etc. are the most popular corporations that have created history in the e-age. Before one could go into the success stories of these companies, there is a very interesting, but a new approach in financing these companies that can be observed. To be precise, these companies do business by encasing certain novel ideas that are highly tangible which had not formed the seed of business ventures earlier. Naturally, these new ventures were not started either with any bank loans or through other means of established finance sources. But they depend on a special means of financing called Venture Capital (VC). The concept and modus operandi of this financing requires thorough understanding when one aspires to use it for a sustainable future.

Intel, Google, Apple, Facebook, Digital Equipment Corporation, Genentech, etc. are the most popular corporations that have created history in the e-age. Before one could go into the success stories of these companies, there is a very interesting, but a new approach in financing these companies that can be observed. To be precise, these companies do business by encasing certain novel ideas that are highly tangible which had not formed the seed of business ventures earlier. Naturally, these new ventures were not started either with any bank loans or through other means of established finance sources. But they depend on a special means of financing called Venture Capital (VC). The concept and modus operandi of this financing requires thorough understanding when one aspires to use it for a sustainable future.

For a common man, one can say that the VC institutions are those institutions which come forward to finance any venture that carries a lot of risk with it for which normal financial institutions hesitate to offer any financial assistance. In a way, VC is a form of risk capital1. Capital invested in a venture (can be a project or business or firm) with substantial element of risk relating to the generation of profit in future, assumes the form of equity investment with the expectation of the highest return. Precisely, VC is the financial capital provided to the early-stage, high potential, growth startup companies. The VC fund makes money by owning equity in the companies it invests in, which usually have a novel technology or business model in high technology industries, such as  biotechnology, IT, Software, etc. The typical VC investment occurs after the seed funding round while growth funding round (also referred to as Series ‘A’ round) takes a vital shape in the interest of generating a return through an eventual realization event.

biotechnology, IT, Software, etc. The typical VC investment occurs after the seed funding round while growth funding round (also referred to as Series ‘A’ round) takes a vital shape in the interest of generating a return through an eventual realization event.

VC supports new ventures with limited operating history that are normally too small to raise capital in the public markets. In exchange for high risk, venture capitalists do come forward by investing in smaller and less mature companies. Venture capitalists usually get significant control over company’s decisions; in addition to a significant portion of the company’s ownership (and consequently value)2. This may seem to be a little silly. If such is the case, then how do these VC investments make profits? Here lies the beautiful solution. VC is associated with well diversified portfolios. Suppose, if it is invested in twenty projects at a time. Of this twenty, nineteen could fail, but the one that would succeed would cover up all the losses and would earn a huge surplus indeed. VC is associated with a sizeable creation of employment, output and income in both developed and developing countries3. Above all, VC is a proxy measure to advancement in innovation and risk-bearing capability of an economy. Hence, it goes well with the typical characteristics of a developed economy.

The origin of VC is still unknown; however, one can trace for an earliest example of venture capital when Queen Isabella gave Columbus some money to find a route to India4. The organized form of VC however began immediately after the World War II by American Research and Development Corporation (ARDC). The funds were invested in diversified areas; chief one being technology5. When one talks of the Indian context, the first venture capital in India started during the 1970s in Gujarat6. The present study is interested to know the scope of VC for green technology and its challenges in the path of sustainable development (SD). One should understand that a VC is different from other types of finance:

- The VC provides funding as well as guidance.

- It is equity funding in contrast to bank loans.

- It provides great value adding role, which is usually difficult to obtain from many institutions.

- It also provides several distinctive services which normal financial institutions would provide in general.

There are three important stages of VC funding:

- Early stage funding for setting up of a firm, a plant, etc.

- Expansion Stage for further developing of a firm.

- Acquisition/Merger, when one firm takes over the other.

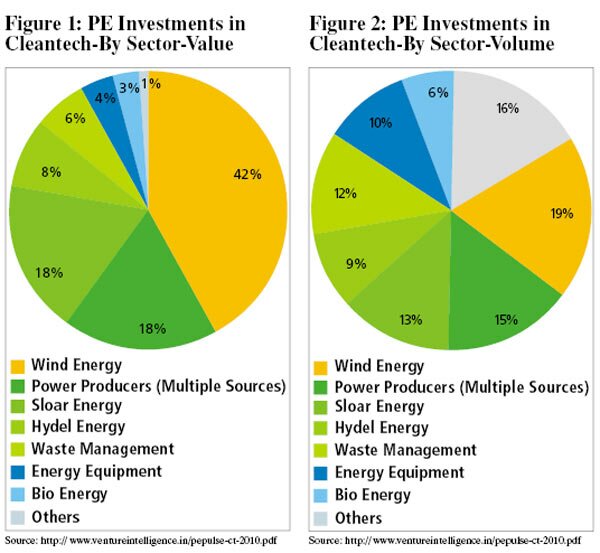

Above all, a VC institution is chiefly characterized by distinct features: Prudence, Patience and Perseverance. Figures 1 and 2 show the sectoral composition of PE Investments in Cleantech by value and also by their volume of investments.

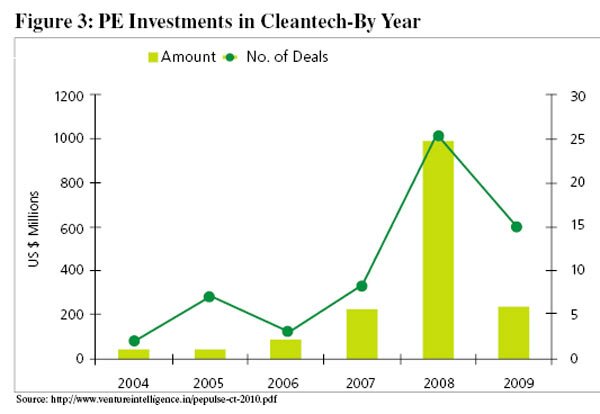

Picking up the straw from here, one can raise a question: Why not the VC institutions target at investments in Green Technology? If they could do so, it would certainly be a profit generating, corporate- social responsibility. Moreover, VC investments in Green Technology will work as a catalyst in the path of sustainable economic development. However, with the recession in its peak during the late 2008, the investments in Greener Energy have fallen down (See, Figure 3). With the labor market getting warmed up and money has become little inexpensive by 2010, investments in Cleantech are bound to increase in the future.

Role of Energy in Human Life

None can deny that humans need energy for all types of function they perform. Right from keeping their houses warm/cool to run an industry or to make agriculture contribute or even to keep the body of the individual warm or alive, energy is required. Energy is obtained from renewable and non-renewable sources. But, a large population of the world heavily depends on non-renewable energy sources, commonly known as fossil fuels. The non-renewability of these sources causes their prices to rise up7 and it may reach a point where they are no longer economically feasible. At present the price rise of fossil fuels can be attributed to increase in consumption and other demand side constraints while the supply of these being more or less fixed relatively to the increase in demand. It is also realized that burning fossil fuels is responsible for the impending crises that are high on the political agenda of modern Governments. Their concern is more about emission, acidification, air pollution, water pollution, damage to land surface, ground water contamination, ozone layer depletion, etc.

Notwithstanding the evil effects of fossil fuels, the world community is clinging on to them for its energy requirements for the simplest reason that the alternative sources of energy are relatively costly since the right kind of technology/ innovation has not gone into them. Sporadic business ventures have taken place world over to go in for alternative sources of energy more with a view to mitigate the energy costs. A survey conducted by the Small Business Research Board found that health concerns are now overshadowed by worries about the impact of energy and fuel costs.8

Renewable Energy — the best Alternative

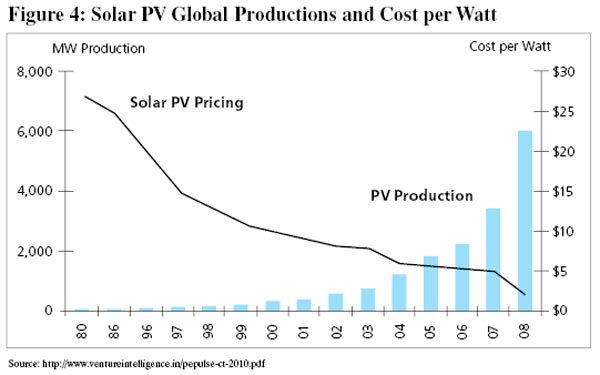

The present day renewable energy industry focuses on new and appropriate renewable energy technologies, which excludes large scale hydro-electricity. In many cases, this has translated into rapid renewable energy commercialization and considerable industry expansion too. The wind power, geothermal energy, biomass, and photovoltaic (PV) industries are good examples of this fact. Over the years it has been observed that the production of Solar Energy has been on the rise. Interestingly, the cost per watt has also been falling considerably which sends positive signal for investments in the solar energy (See, Figure 4).

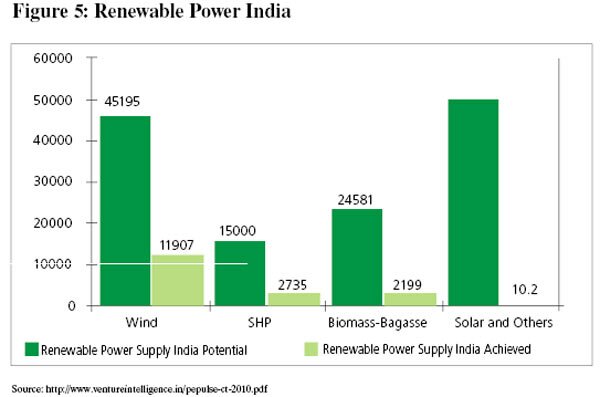

According to the Renewable 2010 Global Status Report, renewables comprise fully one quarter of global power capacity from all sources and deliver 18 percent of global electricity supply in 20099. Investments in new renewable power capacity continue to increase, despite challenges posed by the global financial crisis. To be precise, the renewable generating capacity installed over the past two years accounts for nearly 50 percent of total generating capacity added to the world’s grids over this period. Moreover, half of the existing renewable power capacity is in developing countries. Another milestone in this sector is that in early 2010 more than 100 countries have framed some policy target related to renewable energy. Renewable markets are growing at rapid rates in many developing countries including China and India (See, Figure 5). Excluding large hydro, total investment in renewable energy capacity was about US $ 150 b in 200910.

The leading renewable energy private investors are First solar, Gamesa, GE Energy, Q Cells, sharp Solar, Siemens, SunOpta, Suntech, and Vestas. In India the Government is keen on promoting Solar Energy by offering security to the investments on this project. In support to this, PV installations have also become cheaper since the middle of 2009. This has lead to 40-60 percent investment cost per kilowatt and has made it cost competitive11.

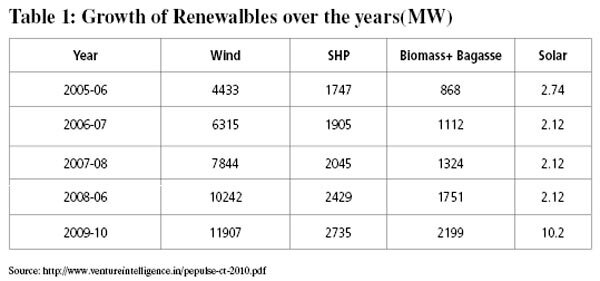

It is very relevant to note the increased growth of renewables over the years (See, Table 1). Being a land of renewable resources, there are huge opportunities that lie in the development of renewable energy in India. In 2000, VC investment in renewable energy was about one percent of total VC investment. In 2007, that figure was closer to 10 percent with solar power alone making up to three percent of the entire VC asset class of US $33 b. In 2009, the VC investment stood at US $6.4 b12. The International Energy Agency (IEA) predicts US $ 20 trillion will be invested into alternative energy projects over the next 22 years13.

Among the early investors in the sector, Kleiner Perkins Caufield and Byers happens to be a high profile venture capital investor in Silicon Valley. Its partner John Doerr opined at an energy conference in Stanford University that the single largest economic opportunity of the 21st century would be on clean technology14.

Thus one can say here that there is a lot of scope for VC to flow in the domain of renewable energy, which is the first step towards Greener Future. The other potential area of attraction for VC to ensure a sustainable future is tackling the menace of e-waste. VC venture in the case of former is a forward move whereas in the case of latter, it is a counter-active move.

E-Waste — the Fastest Growing Waste Stream

High tech consumerism is growing at an unprecedented rate globally. It is contributing to the already existing, but increasingly urgent problem of e-waste. Anything that has a wire, a plug, a battery or runs on electricity that isn’t used over again comprises Electronic Waste. E-Waste is the by-product of technological revolution. When disposed off in a landfill, it becomes a conglomeration of plastic and steel casings, circuit boards, glass tubes, wires, resistors, capacitors, fluorescent tubes, and other assorted parts and materials. It is both valuable as a source of secondary raw material and toxic if not treated and discarded properly.

E-waste is one of the fastest growing waste streams, with people changing their electronic gadgets more frequently than ever before. It is because; the world of electronics exemplifies the dictum, out with the old, in with the new. It makes up five percent of all municipal solid wastes worldwide15. So, it is of great relevance to all indeed especially in a world where sustainability is increasingly perceived as the benchmark of advancement. Though electronics and technology have revolutionized people’s way of life, some of its detrimental effects need to be addressed. E-Waste, contrary to its nomenclature, has a significant value attached to it too. If treated properly, it can be reclaimed and recycled for future use and converted into a significant new revenue stream. Inappropriate treatment of e-waste, on the other hand, poses a massive threat to the world’s ecosystem and a pernicious threat to human life.

The amount of e-waste generated in India is expected to touch a whooping figure of one million ton by 2012. From the current level of 4.4 lakh tons per annum16, by 2015, two billion PCs are expected to invade Indian homes and our India’s mobile subscriber base is expected to expand to the tune of 450 million subscribers. The e-waste generated by these two segments itself would be staggering.

Science Daily reports that the sale of electronic products in countries like China and India and across continents such as Africa and Latin America are set to rise sharply in the next ten years17. It continues to emphasize that developing countries will be producing at least twice as much e-waste as developed countries within the next 6-8 years18. It foresees that by 2030, developing countries would discard 400 million —700 million obsolete personal computers per year, compared to 200 million — 300 million in developed countries then.

At this juncture, the UN under Secretary General, Konrad Osterwalder opines that one person’s waste could become raw material for another19. From this angle, if one looks at the problem of e-waste, it can be a foot-hold or the transition to a green economy. In other words, what is called for here is the promotion of smart technologies and mechanisms with the support of national and international policies to transform this waste into wealth.

In addition, recycling20 the e-waste has a lot of potential to become alternate sources of energy. The traditional practice of mining involves extraction of metals and precious stones from the Earth, which is a very strenuous/complex procedure, involving high costs and titanic amounts of energy consumption. Besides, most of the natural resources are non-renewable. Hence, there is a need to lookout for alternative sources of energy. But, e-waste recycling not only saves inputs associated with manufacturing new products and virgin raw materials but also helpful in conserving and preserving many precious metals that are used in the circuit boards of many of the electronic items. A market study by ABI Research on e-waste Recovery and Recycling forecasts that the worldwide market for e-waste recovery will grow from $ 5.7 billion in 2009 to nearly $ 14.7 billion by the end of 2014, representing a compound Annual growth rate of 20.8 percent over the forecast period. This figure represents the amount of opportunity in monetary terms, generated through reclamation of valuable materials from e-scrap21.

While inaugurating Attero Recycling22, a private e-waste management company, former President of India, Dr. A.P.J Abdul Kalam noted, “a tonne of ore from a gold mine produces just five grams (0.18 ounce) of gold on an average, whereas a tone of discarded mobile phones can yield 150 grams (5.3 ounces) of the same.” According to Mr. Mark Small, Vice President of Corporate Environment Safety and Health for Sony Electronics, mining produces approximately 300 times more waste than electronics does every year. He too opined, “e-waste is often richer in rare metals than virgin materials, containing 10 to 50 times higher copper content than copper ore. A cell phone contains 5-10 times higher gold content than gold ore.”23

Researches show that out of total e-waste generated in India, only five percent goes to the organized recyclers. The e-waste disposal system in India is a flourishing business in the informal sector and the processes are often shoddy and extremely damaging. Another disturbing fact is that on account of poor environmental policy in India, it has become a preferred destination of dumping e-waste from all over the world24. However the solution lies in creating awareness among the people of all walks of life to give a green burial (recycling) to electronic goods.

Venture Capital and Greener Future

To ensure a sustainable Greener Future, a well defined Energy Policy with a top priority to a wide spectrum of use of renewable energy is the primary requirement. It should go with a spontaneous political support for realizing the objective in record time. In addition, a massive programme of this nature calls for an effective public-Private Sectors partnership. Naturally, this effort will result in the rise in output, employment generation, sectoral development, expansion of markets and marked improvement in environment.

The UN on its part introduced the UNEP Green Economy Initiative (GEI) in October 2008 with a view to mobilizing and refocusing the global economy towards investments in clean industries and technologies and natural infrastructure by reducing environmental insecurity. It also wanted to ensure that sustainable wealth creation and achievement of the Millennium Development Goals (MDGs) must go with this initiative25.

The UN on its part introduced the UNEP Green Economy Initiative (GEI) in October 2008 with a view to mobilizing and refocusing the global economy towards investments in clean industries and technologies and natural infrastructure by reducing environmental insecurity. It also wanted to ensure that sustainable wealth creation and achievement of the Millennium Development Goals (MDGs) must go with this initiative25.

The financial-fuel-food crises that have engulfed the world economies in the last couple of years coupled with environmental problems paralyzed the progress towards the achievement of MDGs. One glaring cause for the 3Fs-crises happens to be the misplaced investments with selfish motive to make money at the cost of generating ill-fare in the world economy. GEI was initiated to counter the evil effects of these crises26 with an estimated investment of US$ 750b27.

UN wanted to impress upon the world economy by preparing and presenting a Green Economy Report based on the data collected from a range of sectors, wherein GEI had been pushed through. In addition, it expected that less-developed countries to appreciate that GEI could bring economic recovery faster and lead to future prosperity by ensuring job creation and at the same time addressing the social and environmental challenges that have taken place for the past two years on account of GEI.

A few noted developments28 can be presented here:

* Climate change funding has been initiated the world over. For e.g.

- IDB supports Peru’s climate change program

- AFDB launches African Carbon Support Project.

- Asian countries to get US $ 800 m from CIF (Climate Investment Funds) for investments in clean energy and low carbon growth.

- ADB provides US $ 150 m to an urban transport Project in China that aims at cutting harmful Greenhouse gas emissions.

* Green Electricity Projects are encouraged and many developing countries are for them. For example,

- World Bank has offered to Kenya to push through a project on this line to connect 1.5 m more people and businesses by 2015.

* World Bank has launched a new National Accounting System wherein ecosystem valuation is ingrained into national accounting procedure of the developed and developing countries.

* High priority has been given for investments in renewable energy and creating green jobs. For example,

- The Green jobs initiative has been undertaken by UNEP, ILO, IEO and ITUC.

- Wind energy alone could achieve up to 65 percent of the emission-reductions.

- In tune with this, Kenya builds up wind farms in Africa with the support of African Development Bank (AFDB) at a cost of US $ 405 m.

- Under the aegis of this initiative, by investing US $ 630 b in the renewable energy sector alone, by 2030, 20 m additional jobs are expected to be created. During 2008-10, 2.3 m people have found jobs in this sector.

- Between 2008 to 2010, many countries (both developed and developing) have made use of these initiatives as opportunity amid crisis and have been benefited immensely29.

* A few striking illustrations:

* China has emerged the world’s second biggest user of Wind energy; the biggest exporter of photovoltaics. 10 percent of its households have solar water heaters and 1.5 m people are employed in its renewable sector.

* In Brazil, the average area of green space per person has risen from one square meter to 50 square meters following GEI –creative and forward looking urban planning.

* In Nepal, 14000 Forest user Groups have reversed the deforestation rates of the 1990s through GEI-community based policies.

* Uganda has turned its agricultural operations fully organic based and it boosted its farm incomes and farm exports.

* Bangladesh provides subsidized microfinance assistance to invest on solar heating systems. In this process, it aims at creating 0.1 m new jobs by 2015.

* In Venezuela, an ethanol blend of 10 percent in fuels is expected to generate on million jobs in agriculture by 2012.

* India, from its side, is not only for National green Accounting System30, but voluntarily decides to reduce the carbon intensity across the country by 20-25 percent from the 2005 levels.

- Green jobs are created in manufacturing several tools required for promoting alternative sources of energy.

- The initiatives to convert fossil-fueled transport system in metropolis to bio-fueled transport system in phased manner have created green jobs.

- To be precise, India has proposed to generate 0.9 m jobs by 2025 in bio-gas sector31.

* In short, the UN is of the opinion that 1.30 b working poor (43 percent of workforce of the globe) in the world with an income of US $ 2 per head would be benefited from GEI in the next 10 years. This could happen because the different sectors of an economy would be supported by renewable power supply, energy efficient buildings and construction, bio-fueled transport system, GEI supported basic industries, agriculture and forestry.

Green Investments for Green Future

At present, green/ clean technology is one of the fastest growing sector32. With increasing Governments’ support and growing public awareness and interest in eco-friendly products, many private venture capitalists are forth coming to invest in this sector and offer counseling for greener future. In their opinion, green technologies sell themselves and with the Governments’ pump priming policies towards these ventures, even developing countries like China and India are poised for green future33. In other words, venture capitalists forecast that the field of green technology could be the largest economic opportunity of the 21st century and it is generating buzz in the venture capital community34. More ever, the application of these technologies is quite varied and fundamental to human existence. It ranges from clean air to purified water, alternative fuels, and renewable energy and recycling. Since, the estimated demand for these is fixed at US $ 167 b by 2015,35 the venture capitalists are coming forward to give a fillip to innovations and encourage the market forces to meet the uprising world demand.

In addition to this, there is a lot of scope for a growing economy to use venture capital for Inclusive Growth without sacrificing the basic objective of greener future. In other words, a prudent community can build up its society or reorganize it by making the partners of society, political and economic system to work with a green consumer base by using the synergistic approach36 to address the needs and up keep of the down trodden with the support of innovative approach and VC.

Of course, the VC initiatives, after the economic down turn around the world, have shrunk a bit37. But the modern governments are well focused to address the climate change as well as energy independence. This is bound to mitigate the intensity of the trend in melt down. At present, the VC investments have moved towards promoting solar energy technologies, green building applications and energy storage technologies.

Conclusion

In short, Venture Capital (VC), a form of risk capital, is associated with the creation and promotion of many economic activities both in developed and developing countries. In this study, an attempt is made to identify the scope of VC in promoting green technologies that support the path of Sustainable Development. Moreover, this study has surveyed the approach that mitigates the environmental crisis which has been engulfing the world community at present. Finally, it attempts to focus on ensuring energy security in a given time frame with the support of VC investments which have enormous scope to contribute and be profited thereby.

End-notes and Additional Thinking

1 See, www.ventureintelligence.in (Accessed on Nov.18, 2010)

2 See, en.wikipedia.org/wiki/venture capital (Accessed on Mar 8, 2010)

3 For e.g. it accounts for 21 percent of the US GDP. See www.nvca.org (Site visited on Dec. 25, 2010).

4 www.fundisabella.com (Accessed on Dec. 25, 2010).

5 www.investopedia.com (Accessed on Dec.25, 2010).

6 www.gvfl.com (Accessed on Dec.25, 2010).

7 The historic highest price of crude oil was US $145 on 14th July, 2008. It softened later and when economic recession is still holding the world economy, it is showing a rising trend and bringing the world economy to its knees. The crude oil price as on Thursday, the Mar. 3, 2011 is US $ 101.67. See, www.oil-price.net (visited on Mar. 3, 2011.

8 See, www.ipasbrb.net ( Accessed on Dec 26, 2010)

9 Janet Sawin, Eric Martinet and David Appleyard, (2010), Renewables Continue Remarkable Growth, renewableenergyworld.com (Accessed on 26th December 2010).

10 Ibid

11 Vidyabala, Solar Energy Is Going To Get Cheaper, The Hindu-Businessline, Dated Dec 28th, 2010, p 9

12 www.pewtrusts.org (Accessed on 28th Dec, 2010).

13 En.wikipedia.org/wiki/renewable_energy_industry (Accessed on 28th December 2010).

14 Greenvsummit.com/assets/files/ecoll_presentation_Dec 06, 2010 (Accessed on 28th Dec 2010.)

15 Rampati kumar, Electronic Trash: A looming Crisis. The Hindu: Survey of Environment, 2008, p 17.

16 Economictimes.indiatimes.com (Site visited on 30th December, 2010); the Economic Times dated 1st October 2010.

17 Science Daily dated 23rd February 2010. See www.sciencedaily.com (Accessed on 30th December, 2010).

18 Ibid. Dated April 29, 2010

19 See, Science Daily Dated 23rd February, 2010

20 This has involved greater diversion of electronic waste from energy-intensive down cycling processed to a raw material form.

21 See, www.abiresearch.com (Accessed on 31st December 2010).

22 This is an e-waste recycling firm started at Roorkee, Uttaranchal, with an investment of Rs. 30,000 crore, has the capacity of processing and recycling 36,000 tons of e-waste per annum. It has 150 clients in India to collect e- waste. See mygreenchannel.org (Accessed on 4th January, 2011.)

23 See Kendra Mayfield, New E-waste Solution: A Mine Idea, www.renetworks.net (Accessed on 4th January, 2011)

24 See, mygreenchannel.org (Accessed on 4th January 2011.)

25 www.unep.ch/etb/events/GreenEconomyworkshop 28-30 April 2009. (Accessed on 5th January 2011.)

26 www.unep.org/PdF/towards Green Economy. (Accessed on 5th January 2011.)

27 www.unep.org/Realizing a Green New Deal (Accessed on 5th January 2011.)

28 Greeneconomyinitiative.com (Accessed on 31st January 2011.)

29 UNEP Report: dated 20th September 2010. (See www.unep.org).

30 See, Economic and Fiscal Instruments for a green Economy, Presentation at Santiago de Chile, 20th January 2011. www.eclac.org. ( Accessed on 3rd February 2011.)

31 Silicon india News/ 6th October 2008.See www.siliconindia.com (Accessed on 3rd February 2011.)

32 See, track.in/tags/business/ Dated 23rd July 2010.

33 Jack Reerink and Peter Henderson, Mr. Cleantech Doubles Down on Green Future, www.reuters.com (Accessed on 15th February 2011.)

34 Betting on a Green Future. See www.wired.com

35 Ibid.

36 www.imaginegreenfuture.blogspot.com (Accessed on 18th February, 2011.)

37 www.researchandmarkets.com ( Accessed on 19th February 2011.)

(Dr. G. Bhalachandran is professor and head, Department of Economics, Sri Sathya Sai Institute of Higher Learning, Prasanthinilayam campus, Prasanthinilayam. In 1993, he was awarded Ph.D in Economics by Sri Krishnadevaraya University, Anantapur. From 1982 to 2009 he was been a Member, from 2010, he has been the Convener, Board of Studies in Economics, Sri Sathya Sai Institute of Higher learning. He has published several articles and research papers in refereed journals in India and abroad. His area of research is quiet diversified, ranging from Income-Consumption Pattern to Agriculture, Energy Harvesting, Environmental Crisis and to the Models of Sustainable Development.

The paper has been co-authored by Mr. G. Nagarjun (currently pursuing his 2nd year MBA at Sri Sathya Sai Institute of Higher Learning), Mr. P. Arjun Prasad (currently doing his 2nd year MA (Economics) at Sri Sathya Sai Institute of Higher Learning) and Mr. Ishuwar Seetharam (currently studying Masters in Economics at the University of Warwick, United Kingdom.)

The views expressed in the article are personal and do not reflect the official policy or position of the organisation.)

<

|

| |

|

| |

|

|

*

|

| Name: |

* |

| Place: |

* |

| Email: |

* *

|

| Display Email: |

|

| |

|

| Enter Image Text: |

|

| |

|