FINANCIAL ECONOMICS

Greek Crises & its Impact on the World Economy

T.Koti Reddy, Professor in Economics, IBS Hyderabad 1/1/2011 10:43:51 PM

The economy of Greece is the twenty-seventh largest economy in the world by nominal gross domestic product (GDP) and the thirty-third largest by purchasing power parity, according to the data given by the International Monetary Fund1 for the year 2008. Its GDP per capita is the 25th highest in the world, while it’s GDP PPP per capita is also the 25th. Greece is a member of the OECD, the World Trade Organization, the Black Sea Economic Cooperation, the European Union and the Euro zone.

The Greek economy is a developed economy with the 22nd highest standard of living in the world2. The public sector accounts for about 40% of GDP. The service sector contributes 75.8% of the total GDP, industry 20.8% and agriculture 3.4%. Greece is the twenty-fourth most globalized country in the world and is classified as a high income economy.

The Greek economy is a developed economy with the 22nd highest standard of living in the world2. The public sector accounts for about 40% of GDP. The service sector contributes 75.8% of the total GDP, industry 20.8% and agriculture 3.4%. Greece is the twenty-fourth most globalized country in the world and is classified as a high income economy.

History

Greece adopted the euro as its currency in January 2002. The adoption of the euro provided Greece (formerly a high inflation risk country under the drachma) with access to competitive loan rates and also to low rates of the Eurobond market. This led to a dramatic increase in consumer spending, which gave a significant boost to economic growth.

Between 1997-2007, Greece averaged four percent GDP growth, almost twice the European Union (EU) average. As with other European countries, the financial crisis and resulting slowdown of the real economy have taken their toll on Greece’s rate of growth, which slowed to two percent in 2008. The economy went into recession in 2009 and contracted by two percent as a result of the world financial crisis and its impact on access to credit, world trade, and domestic consumption — the engine of growth in Greece. Key economic challenges with which the government is currently contending include a burgeoning government deficit (13.6% of GDP in 2009), escalating public debt (115.1% of GDP in 2009), and a decline in competitiveness. The EU placed Greece under its Excessive Deficit Procedure in 2009 and has asked Greece to bring its deficit back to the three percent EU ceiling by 2012. In late 2009, eroding public finances, misreported statistics, and inadequate follow-through on reforms prompted major credit rating agencies to downgrade Greece’s international debt rating, which has led to increased financial instability and a debt crisis.

Under intense pressure by the EU and international lenders, the Greek Government has adopted a three-year reform program that includes cutting government spending, reducing the size of the public sector, tackling tax evasion, reforming the health care and pension systems, and improving competitiveness through structural reforms to the labor and product markets. The Greek Government projects that its reform program will achieve a reduction of Greece’s deficit by four percent of GDP in 2010 and allow Greece to decrease the deficit to below three percent by 2012. In April 2010, Greece requested activation of a joint European Union-International Monetary Fund support mechanism designed to assist Greece in financing its public debt.

The financial crisis and the consecutive recession caused an increase in unemployment to nine percent in 2009 (from 7.5% in 2008). Unfortunately, foreign direct investment (FDI) inflows to Greece have dropped, and efforts to revive them have been only partially successful as a result of declining competitiveness and a high level of red tape and bureaucracy. At the same time, Greek investment in Southeast Europe has increased, leading to a net FDI outflow in some years.

Greece has a predominately service economy, which (including tourism) accounts for over 73% of GDP. Almost nine percent of the world’s merchant fleet is Greek-owned, making the Greek fleet the largest in the world. Other important sectors include food processing, tobacco, textiles, chemicals (including refineries), pharmaceuticals, cement, glass, telecommunication and transport equipment. Agricultural output has steadily decreased in importance over the last decade, accounting now for only five percent of total GDP. The EU is Greece’s major trading partner, with more than half of all Greek two-way trade being intra-EU. Greece runs a perennial merchandise trade deficit, and 2009 imports totaled $64 billion against exports of $21 billion. Tourism and shipping receipts together with EU transfers make up for much of this deficit.

European Union (Eu) Membership

Greece has been a major net beneficiary of the EU budget; in 2009, EU transfers accounted for 2.35% of GDP. From 1994-99, about $20 billion in EU structural funds and Greek national financing were spent on projects to modernize and develop Greece's transportation network in time for the Olympics in 2004.

The centerpiece was the construction of the new international airport near Athens, which opened in March 2001 soon after the launch of the new Athens subway system.

EU transfers to Greece continue, with approximately $24 billion in structural funds for the period 2000-2006. The same level of EU funding, $24 billion, has been allocated for Greece for 2007-2013. These funds contribute significantly to Greece's current accounts balance and further reduce the state budget deficit. EU funds will continue to finance major public works and economic development projects, upgrade competitiveness and human resources, improve living conditions, and address disparities between poorer and more developed regions of the country. They are planned to be phased out in 2013.

US-Greece Trade

In 2008, the US trade surplus with Greece was $1.1 billion. There are no significant non-tariff barriers to American exports. US exports to Greece reached $2.4 billion, accounting for 2.7% of Greece's total imports in 2008. The top US exports remain defense articles, although American business activity is expected to grow in the tourism development, medical, construction, food processing, and packaging and franchising sectors. US companies are involved in Greece's ongoing privatization efforts; further deregulation of Greece's energy sector and the country's central location as a transportation hub for Europe may offer additional opportunities in electricity, gas, refinery, and related sectors.

Objectives of the Study

To Understand the Greek Economy & the Historical Macroeconomic Changes in Greece and the Progress of Greece after Joining European union

To Understand and analyze the reasons behind the Recent Debt Crises in Greece and Its impact on the Global capital Markets & world Economy.

To Highlight the Lessons to be learnt from the Greece Crises & Suggest some policy implications to Greece Government.

Methodology of the Study

The entire study is based on secondary data collected from various news articles & Experts views on the Greece Crises.

Review of Literature

Greece crisis that is the sovereign risk that evolved this year is horrifying. We find the economy totally paralyzed and as Kenneth Rogoff3 said once the fallout of financial Armageddon fades off, it paves the way for fiscal imbalances and sovereign downgrades. If we listen to Niall Ferguson4 at Peterson institute of international economics conference, he draws on a historical perspective of Greece debt crisis. If we go back into the past this is the fifth time that Greece is on the verge of default. But as we know the situation was different then. Why do we say this because Greece had its own monetary framework put in place. So it had the option of devaluing its currency to rescue itself from the chasm. Now situation is different as it is stuck in a monetary union and the unalterable laws framed in the Lisbon treaty at the time of monetary unification makes the situation worse. Then we have bond vigilantes claiming for fiscal austerity in the midst of a turmoil thereby aggravating the financial trauma of Greece.

The situation also has been driven by the continuous fudging of national accounts by making use of currency swaps just to mask the debt situation thereby trying to create an image that the norms prescribed in the Maastricht treaty are followed. Greece can’t really inflate the situation away because its hands are tied to ECB. There is no currency option as well. The only way to come out of this pothole is to restructure its debt and try to restore its budget imbalances to create some kind of confidence for its creditors. This suggestion has been provided by many economists across the globe. We have seen Greece getting help from Germany and France as well. The countries have responded cohesively and have calmed the markets and have held the monetary union together just to keep the euro smiling. The situation is good so far if we go by the cds spreads. We never know if there is a financial implosion which could the push the economy back into the mess. The measures have taken up by Greece finance minister and the president. The situation is under control according to them.

Greece’s Debt Crisis

How All It Happened?

Over the last ten years, to fund the Government budget and current account deficit5 Greece government barrowed heavily from international capital markets. In the period between 2001 and 2008, when Greece adopted euro as its currency, they reported budget deficit of Greece averaged five percent per year, compared to the average budget deficit of two percent for the entire Euro zone, and the reported current account deficit of Greece averaged nine percent per year, compared to the average current account deficit of one percent for the entire Euro zone. But as per the revised Statistics in 2009, the budget deficit is estimated to have been more than 13% of GDP, and many attributed these high budget and current account deficits to the high spending of successive Greek governments. As discussed earlier Greece government funded both of these deficits by borrowing from Global capital markets, leaving Greece with high external debt i.e., 115% of GDP in 2009. But this High Level of Budget deficit & Current account deficit are well above those permitted by the rules governing the EU’s Economic and Monetary Union (EMU). Even though the US financial crises led to Liquidity problems in most of the world economies, the Greek government managed to raise the funds from international markets. The financial crises which led to global economic slow down placed a lot of pressure on the governments of various economies including Greece, resulted in increases in Government expenditure & decrease in Tax Revenues.

Over the last ten years, to fund the Government budget and current account deficit5 Greece government barrowed heavily from international capital markets. In the period between 2001 and 2008, when Greece adopted euro as its currency, they reported budget deficit of Greece averaged five percent per year, compared to the average budget deficit of two percent for the entire Euro zone, and the reported current account deficit of Greece averaged nine percent per year, compared to the average current account deficit of one percent for the entire Euro zone. But as per the revised Statistics in 2009, the budget deficit is estimated to have been more than 13% of GDP, and many attributed these high budget and current account deficits to the high spending of successive Greek governments. As discussed earlier Greece government funded both of these deficits by borrowing from Global capital markets, leaving Greece with high external debt i.e., 115% of GDP in 2009. But this High Level of Budget deficit & Current account deficit are well above those permitted by the rules governing the EU’s Economic and Monetary Union (EMU). Even though the US financial crises led to Liquidity problems in most of the world economies, the Greek government managed to raise the funds from international markets. The financial crises which led to global economic slow down placed a lot of pressure on the governments of various economies including Greece, resulted in increases in Government expenditure & decrease in Tax Revenues.

The whole problem started during late 2009 when the new socialist government, led by Prime Minister George Papandreou, released the revised estimates of the government budget deficit for the year 2009 from the existing estimate of 6.7% of GDP to 12.7% of GDP6. Subsequent to this three main credit rating agencies downgraded the Greek bonds, which actually made investors to loose the confidence on Greek Economy. Countries with large external debts, like Greece, were of particular concern for investors. Allegations that Greek governments had falsified statistics and attempted to obscure debt levels through complex financial instruments also contributed to a drop in investor confidence. Before the crisis, Greek 10-year bond yields were 10 to 40 basis points above German 10-year bonds. With the crisis, these spreads increased to 400 basis points in January 2010, which was at the time a record high7. High bond spreads indicate declining investor confidence in the Greek economy.

Despite increasing nervousness surrounding Greece’s economy, the Greek government was able to successfully sell €8 billion ($10.6 billion) in bonds at the end of January 2010, €5 billion ($6.7

Billion) at the end of March 2010, and €1.56 billion ($2.07 billion) in mid-April 2010, albeit at high interest rates8. However, Greece must borrow an additional €54 billion ($71.8 billion) to cover maturing debt and interest payments in 2010, and there are concerns about the government’s ability to do so.

At the end of March 2010, the Euro zone member states pledged to provide financial assistance to Greece in concert with the IMF, if necessary and if requested by Greece’s government. In mid- April 2010, the details of the proposed financial assistance package for this year were released: a three-year loan worth €30 billion ($40 billion) at five percent interest rates, above what other Southern European countries borrow at, but below the rate currently charged by private investors on Greek bonds. It is expected that an IMF stand-by arrangement, the IMF’s standard loan for helping countries address balance of payments difficulties, valued at €15 billion ($20 billion) for this year would precede any assistance provided to Greece by the Euro zone members. Investor jitteriness spiked again in April 2010, when Euro stat released its estimate of Greece’s budget deficit. At 13.6% of GDP, Euro stat’s estimate was almost a full percentage higher than the previous estimate released by the Greek government in October 20099. This led to renewed questions about Greece’s ability to repay its debts, with €8.5 billion ($11.1 billion) falling due in mid-May 2010. On April 23, 2010, the Greek government formally requested financial assistance from the IMF and other Euro zone countries. The European Commission, backed by Germany, requested that the details of Greece’s budget cuts for 2010, 2011, and 2012 be released before providing the financial assistance. In late April 2010, the spread between Greek and German 10- year bonds reached a record high of 650 basis points, and one of the major credit rating agencies, Moody’s, downgraded Greece’s bond rating.

Possible Causes of the Crisis

Greece’s current economic problems have been caused by a mix of domestic and international factors. Domestically, high government spending, structural rigidities, tax evasion, and corruption have all contributed to Greece’s accumulation of debt over the past decade. Internationally, the adoption of the euro and lax enforcement of EU rules aimed at limiting the accumulation of debt are also believed to have contributed to Greece’s current crisis.

Domestic Factors

High Government Spending and Weak Government Revenues

Between 2001 and 2007, Greece’s GDP grew at an average annual rate of 4.3%, compared to a Euro zone average of 3.1%10. High economic growth rates were driven primarily by increases in private consumption (largely fueled by easier access to credit) and public investment financed by the EU and the central government. Over the past six years, however, while the central government expenditures increased by 87%, revenues grew by only 31%11, leading to budget deficits well above the EU’s agreed-upon three percent of GDP threshold. Observers identify a large and inefficient public administration in Greece, costly pension and healthcare systems, tax evasion, and a general “absence of the will to maintain fiscal discipline” as major factors behind Greece’s deficit.

According to the OECD, as of 2004, spending on public administration as a percentage of total public expenditure in Greece was higher than in any other OECD member, “with no evidence that the quantity or quality of the services are superior.” In 2009, Greek government expenditures accounted for 50% of GDP. Successive Greek governments have taken steps to modernize and consolidate the public administration. However, observers continue to cite over-staffing and poor productivity in the public sector as an impediment to improved economic performance. An aging Greek population — the percentage of Greeks aged over 64 is expected to rise from 19% in 2007 to 32% in 2060 — could place additional burdens on public spending and what is widely considered one of Europe’s most generous pension systems. According to the OECD, Greece’s “replacement rate of 70%-80% of wages (plus any benefits from supplementary schemes) is high, and entitlement to a full pension requires only 35 years of contributions, compared to 40 in many other countries.”12 Absent reform, total Greek public pension payments are expected to increase from 11.5% of GDP in 2005 to 24% of GDP in 2050.

Weak revenue collection has also contributed to Greece’s budget deficits. Many economists identify tax evasion and Greece’s unrecorded economy as key factors behind the deficits. They argue that Greece must address these problems if it is to raise the revenues necessary to improve its fiscal position. Some studies have estimated the informal economy in Greece to represent between 25%-30% of GDP. Observers offer a variety of explanations for the prevalence of tax

evasion in Greece, including high levels of taxation and a complex tax code, excessive regulation, and inefficiency in the public sector. Like his predecessor Constantine (Costas) Karamanlis, Prime Minister Papandreou has committed to cracking down on tax and social security contribution evasion. Observers note, however, that past Greek governments have had, at best, mixed success seeing through similar initiatives.

Structural Policies and Declining International Competitiveness

Greek industry is suffering from declining international competitiveness. Economists cite high relative wages and low productivity as a primary factor. According to one study, wages in Greece have increased at a five percent annual rate since the country adopted the euro, about double the average rate in the Euro zone as a whole. Over the same period, Greek exports to its major trading partners grew at 3.8% per year, only half the rate of those countries’ imports from other trading partners13. Some observers argue that for Greece to boost its international competitiveness and reduce its current account deficit, it needs to increase its productivity, significantly cut wages, and increase savings. As discussed below, the Papandreou government has begun to curb public sector wages and hopes to increase Greek exports through investment in areas where the country has a comparative advantage. In the past, tourism and the shipping industry have been the Greek economy’s strongest sectors.

Consequences of Greek Crisis

As Euro is the common currency for the entire European Union, Euro zone — and all trading partners of Euro zone — is affected due to wide range of currency fluctuations and the Drastic fall in the value of Euro.

The immediate effect of the Greek crises is on the other 15 Euro zone economies as they agreed to help out Greece and hence the taxpayers of these economies will effectively share a part of Greece's burden.

There is also huge fear that the problems associated with Greece economy will have an adverse domino effect on International capital markets. Which in turn affects the weak members of the euro zone, such as the so-called “PIIGS” — Portugal, Ireland, Italy and Spain as well as Greece — all of whom face challenges rebalancing their books.

Rating Agencies also played a crucial role in the entire process. Rating Agencies actually rates countries, companies & financial products like equity & Debt. A country or a company with good rating can raise the funds at a cheaper cost. Now there are concerns that their downgrading of Greece, Spain and Portugal might trigger a sovereign debt crisis, where countries can no longer raise money to pay their bills. This fear resulted in the increase in the interest rates which means that these countries have to pay more intrest to barrow in open market.

The Greek crises has an Impact on the Global banking system also as many Global major banks have invested in the Debt instruments issued by Greece Government. So ultimately this economic crisis will affect many ordinary investors or people who own their shares through pension funds.

Greek crises has also impact on the Currency markets, Most of the Currency traders have feared that some countries with large budget deficits — such as Greece, Spain and Portugal — might be tempted to leave the euro.

The other major problem is with the European Union itself. Any country which left the European Union could allow its currency to fall in value, and there by improving its competitiveness. But it would cause huge ruptures in the financial markets as investors would fear other nations would follow, potentially leading to the break-up of the monetary union itself.

Influence on other Factors

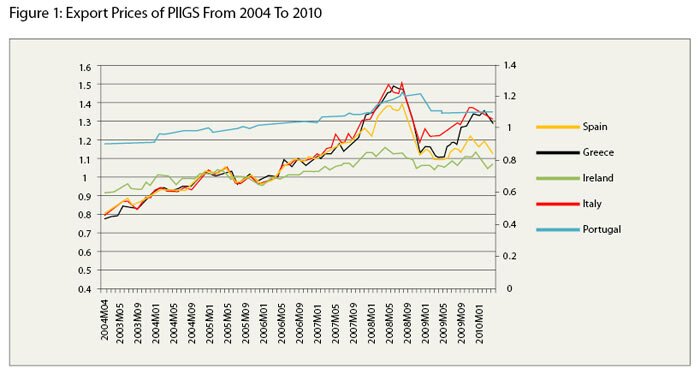

Export Prices

Figure1 shows the trend of Export Prices in PIIGS from 2004 to 2010. Export prices depend on the economic Condition of the country. If the economy is performing well, currency will appreciate and Exports become expensive and vise versa. Now if we look at Figure 1, it shows that till 2007-2008 the euro is appreciating making its export expensive but during the period of Debt Crisis currency falls abruptly making the exports highly competitive but PIIGS are not the major exporters their main source of revenue are shipping and Tourism, which gets highly effected during this period.

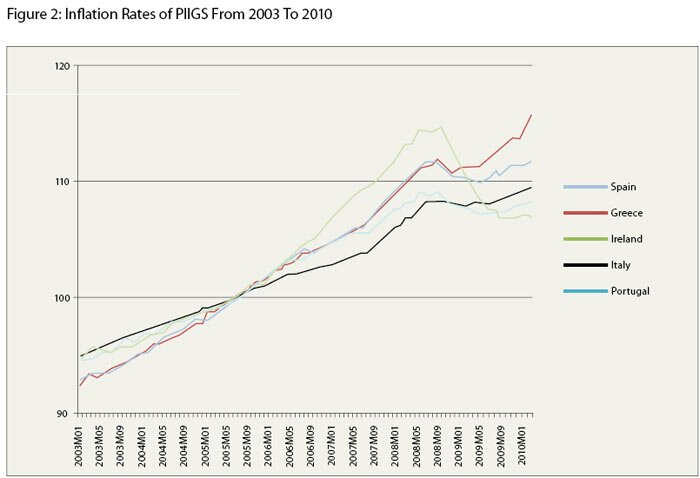

Inflation

Inflation is one of the most important economic indicator. We can see from Figure 2 that the Inflation is growing at a constant pace in PIIGS till 2007 but after that their was a drastic change in the inflation pattern. The rise in inflation is due to high austerity measures taken by the government after the Bailout packages from IMF and ECB.

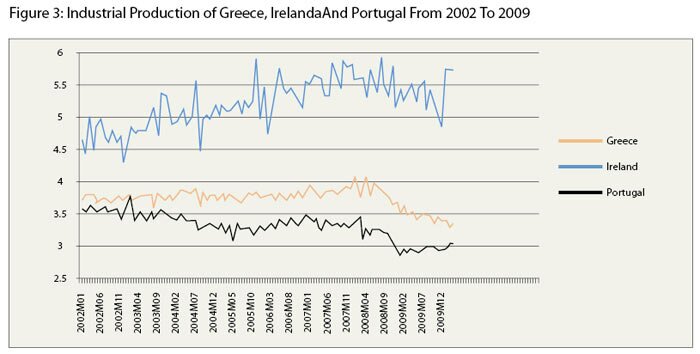

Industrial Production

Index of Industrial Production indicates how well different industry of a country is performing. It generally includes all the industry which has major contribution in GDP. However in Greece shipping and tourism is the major contributor in GDP and the manufacturing sector apart from a few sectors is not developed. During the crisis as we can see from Figure 3, there is decrease in industrial production. However this fall is not significant because shipping and tourism industry is not included in the index.

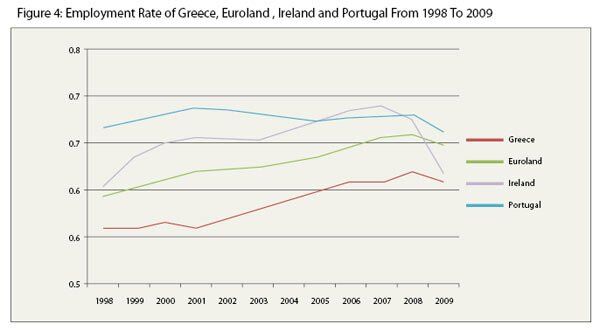

Employment Rate

Figure 4 shows the employment rate in the PIIGS countries. We can see from this that employment is almost steady till 2007-08 but after that the employment fall it was due to the high austerity measures taken by government. These austerity measure fall on the companies and they finally start laying of employees so this is the reason for the high employment rate.

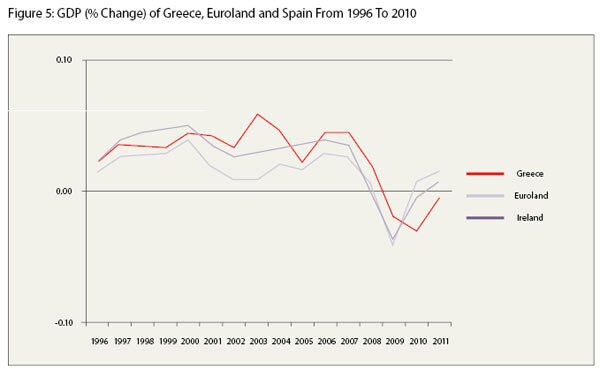

GDP (% change)

GDP is the most important measure of the well being of a country. Figure 5 shows the year on year percentage change of GDP. There has been a continuous growth in the GDP of the two countries from 1996-2007 except a slight glitch in the period 2002-2004. However during the sovereign debt crisis which started showing in the books of account from 2008 there has been a drastic fall in the GDP of both the countries. The crisis then percolated to the entire Europe which is reflected in the change in GDP of the entire Europe.

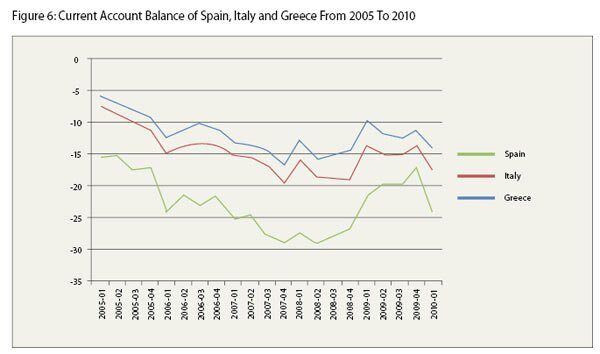

Current Account Balance

Current account is a book of account where all the transaction of a country with rest of the world is recorded. It reflects whether the country is deficit or surplus in trade transactions (export-import). Here we can see that all the three countries has trade deficit. It is because all of them are major importing countries. Since they lie in a financially integrated zone therefore they produce and export in the field where they are better off than others. In other areas their policy is to import. However we can see from the graph that deficit is increasing because of higher import to match increasing domestic demand of the country. This rise in the import is not off set by the export. But since 2009 when the government has announced austerity measure the demand has drastically reduced thus reducing the demand for foreign products (import) and in turn decreasing the trade deficit.

Concusions

The Spillover Effect —

How the Things Could Have Got Affected

This political and economic failure leads to the third Greek warning: that contagion can spread through a large number of routes. A run on Greek banks is possible. So is a “sudden stop” of capital to other weaker euro-zone countries. Firms and banks in Spain and Portugal could find themselves shut out of global capital markets, as investors’ jitters spread from sovereign debt. Europe’s inter-bank market could seize up, unsure which banks would be hit by sovereign defaults. Even Britain could suffer, especially if the May 6th election is indecisive.

This political and economic failure leads to the third Greek warning: that contagion can spread through a large number of routes. A run on Greek banks is possible. So is a “sudden stop” of capital to other weaker euro-zone countries. Firms and banks in Spain and Portugal could find themselves shut out of global capital markets, as investors’ jitters spread from sovereign debt. Europe’s inter-bank market could seize up, unsure which banks would be hit by sovereign defaults. Even Britain could suffer, especially if the May 6th election is indecisive.

So this crisis shows how a debt burden can prove to be a bane to the country. Keeping these symptoms in mind government all over the world has decided to reduce there Debt burden.

If we look at the India, it is having 80% of GDP as a debt burden and government is taking many steps to reduce the debt amount like disinvestment.

Moreover because of financial integration i.e. the formation of Euro is under question as countries don’t have the Monetary power so cant print money neither they can control interest.

End-notes

1 About International Monetary Fund from Wikipedia.

2 About Greece Economy from Wikipedia.

3 Kenneth Rogoff is Professor of Economics and Public Policy at Harvard University, and was formerly chief economist at the IMF.

4 Niall Ferguson, Harvard University, Niarchos Lecture, Peterson Institute for International Economics, Washington DC May 13, 2010

5 The current account is the difference between exports and imports, plus net income payments and net unilateral Transfers. By accounting identity, the current account is equal to net inflows of foreign capital. Current account deficits are financed by foreign capital inflows.

6 “Is Greece Heading for Default?,” Oxford Economics, January 29, 2010.

7 “Fiscal Woes to Dog Greek Bonds Even if Aid Offered,” Reuters, March 22, 2010.

8 Exchange rate used in the memo is the exchange rate April 26, 2010: €1 = $1.331. Source: European Central Bank, http://www.ecb.int/stats/exchange/eurofxref/html/eurofxref-graph-usd.en.html.

9 Peter Garnham, “Greece Crisis Takes Toll on Euro,” Financial Times, April 24, 2010.

10 At constant prices. IMF, World Economic Outlook, October 2009.

11 Update of the Hellenic Stability and Growth Programme, Greek Ministry of Finance, January 2010,

http://www.mnec.gr/export/sites/mnec/en/economics/growth_programme_2005-8/2010_01_15_SGP.pdf.

12 “OECD Economic Survey: Greece,” OECD July 2009.

13 “Is Greece Headed for Default?,” Oxford Economics, January 29, 2010.

References and Additional Thinking

Rebecca M. Nelson, Paul Belkin & Derek E. Mix, April 27, 2010 “Greece’s Debt Crisis: Overview, Policy Responses, and Implications” Congressional Research Service.

"Greek Debt Concerns Dominate – Who Will Be Next? – Seeking Alpha". http://seekingalpha.com/article/183820-greek-debt-concerns-dominate-who-will-be-next. Retrieved on 2nd September 2010.

"ECB suspends rating limits on Greek debt | News". Business Spectator. 22nd October 2007. http://www.businessspectator.com.au/bs.nsf/Article/ECB-suspends-rating-limits-on-Greek-debt-549GS?opendocument&src=rss. Retrieved 5th May 2010.

Jon Hilsenrath, “Q&A: Carmen Reinhart on Greece, US Debt and Other ‘Scary Scenarios’,” Wall Street Journal, February 5, 2010.

Carmen Reinhart, “The Economic and Fiscal Consequences of Financial Crises,” VoxEU, January 26, 2009.

For more on the global financial crisis, see CRS Report RL34742, The Global Financial Crisis: Analysis and Policy Implications, coordinated by Dick K. Nanto.

Niall Ferguson, May 13, 2010, Fiscal crises and imperial collapses Historical Perspectives on Current Predicaments, Niarchos Lecture, Peterson Institute for International Economics, Washington DC.

Kenneth Rogoff, From Financial Crisis to Debt Crisis? Article published in Project Syndicate, 2009, and can be retrieved from http://www.project-syndicate.org/commentary/rogoff60/English.

“2010 European sovereign debt crises” Retrieved from http://en.wikipedia.org/wiki/2010_European_sovereign_debt_crisis.

"Greek debt to reach 120.8 pct of GDP in '10 – draft". 5th November 2009, Retrieved from http://www.reuters.com/article/idUSATH00496420091105

Retrieved 2nd May 2010.

"Greece's sovereign-debt crisis: Still in a spin". Retrieved from http://www.economist.com/displaystory.cfm?story_id=15908288 . Retrieved 2nd May 2010.

"Greeks and the state: an uncomfortable couple". Associated Press. 3rd May 2010. .

"FT.com / Capital Markets – Strong demand for 10-year Greek bond". And can be retrieved from

http://www.ft.com/cms/s/0/245030a8-2773-11df-b0f1-00144feabdc0.html

(Dr. T. Koti Reddy presently working as Faculty in Economics at IBS, Hyderabad. His area of teaching includes Managerial Economics, Macro Economics & Business Environment, International Finance&Trade. He has published widely in International and National Journals. He has authored three books titled: Indian Economy, Interview Manual, Andhra Pradesh Economy and contemporary issues in rural india.His area of interest is Development Economics.

The views expressed in the write-up are personal and do not re?ect the official policy or position of the organization.)

<

|

| |

|

| |

|

|

*

|

| Name: |

* |

| Place: |

* |

| Email: |

* *

|

| Display Email: |

|

| |

|

| Enter Image Text: |

|

| |

|